SAP GTS (Global Trade Services)

Nowadays, companies always look forward to expand their business across the globe. Manufacturing, trade and production processes are becoming complex. Handling business processes are getting difficult. This is due to changing trade regulations, foreign policies and custom rules.

Most companies use legacy systems for foreign trade management processes. These include submitting import/ export declarations, product categorization and warehouse management. So, companies need an integrated system that is to manage and automate all the processes. They want to avoid data loss or administrative burden.

This is where SAP GTS comes in. Using it, you can handle your clients and trade processes. Adhering to the global trade regulations is simpler this way.

What is SAP GTS (Global Trade Services)

SAP GTS allows companies to automate and define their import/ export processes. They can do it while complying with the legal regulations. The software facilitates simple trade management. It ensures proper communication with the trade and custom authorities.

This reduces your time and costs spend over maintaining regulations. As a result, you can focus more on your supply chain. And, you can handle issues that can prevent goods from clearing customs. This boosts your productivity. Time-consuming compliance tasks can be avoided. It helps you to save on customs expenses, which in turn, enhances your company’s revenues.

SAP GTS needs an additional database to run. This is not provided by SAP, and you have to get from the manufacturer. SAP GTS enhances the existing SAP Foreign Trade application, which is also used to handle import/export processes.

Important Features of SAP GTS

1) Export management

GTS handles trade regulations for more than 25 countries. It also takes care of license allocation for products, tracking licenses and license determination.

2) Single data repository

SAP GTS is a centralized data store that can be used along with different ERP systems. All the product classification and compliance data is stored here. Information from different systems such as SAP CRM and SAP SCM can be integrated into this single repository.

3) Import management

This is done by streamlining different processes such as duty calculation, security filing and filing declarations. Customs processes such as inward/outward processing and handling bonded warehouses is easy with GTS.

4) Trade preferences management

Companies can lower the taxes paid for customs declarations using SAP GTS. It’s because SAP GTS handles the following –

- Vendor declaration handling

- Preference determination

- Customer declaration handling

5) Regional procedures

The regional and compliance procedures such as European Excise Movement and Control System (EMCS) are automated with SAP GTS. This also includes Electronic compliance reporting and restitution management.

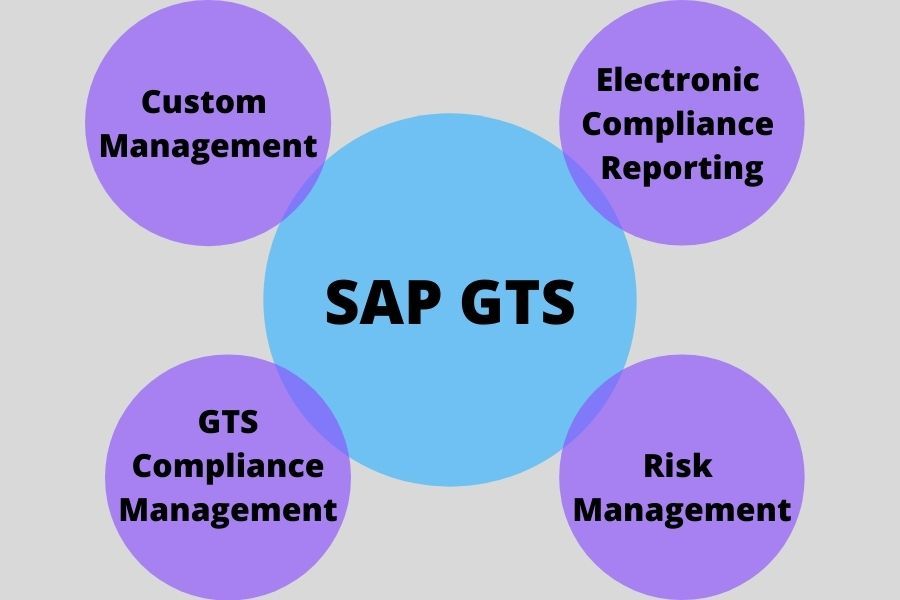

Components of SAP GTS

The four major components of SAP GTS are –

- SAP Custom Management

- SAP GTS Compliance Management

- SAP Electronic Compliance Reporting

- SAP Risk Management

SAP Customs Management

The SAP GTS custom management allows you to handle all the custom processes. It lets you connect with the custom authorities. Handling import/ export, inward processing and custom warehousing can be mapped using GTS. Moreover, it has a duty simulator that lets you manage your duties and taxes.

You can classify your products using international classifications. These include HS, NC and Taric.

Advantages

- Adobe Forms handles printing and dispatching of trade documents

- Broker Enablement solution lets you map more than 14 countries for custom processing

- It helps in product tariffing

- Data transfer from sales and procurement processes to custom documents

SAP GTS Compliance Management

This feature lets you track all tasks related to import and export processes. This ensures that the entire process abides the trade and legal regulations at all times. Companies can monitoring processes such as sanctions and verify business documents.

The feature checks export/import licenses with ease. It integrates the checking operations with existing technologies.

Some salient features of SAP GTS Compliance Management are –

-

Legal control import/export

This enables license determination for inbound/ outbound sales transactions. It lets companies to fulfill complicated license requirements.

-

Sanctioned party list screening

Automated screening processes can help in checking important documents. These can be purchase reports, sales documents and business partner list. You can also work with other related documents too.

SAP Electronic Compliance Reporting

This feature helps companies in submitting the statistical reports during a trade. This applied between 2 European Union member states. For this, the company has to submit the statistics. This has to be as per the data format described by the country’s statistics authorities. This data submission or declaration is called Intrastat declarations.

Furthermore, this reporting allows you to send Intrastat declarations to the appropriate authorities. This results in faster processing of processing of imports and exports. And the automated processes help to increase the company’s productivity.

SAP Risk Management

Risk management enables companies to reduce the financial risks of their trade activities. The main facilities under this feature are –

Preference processing

Preference processing ensures that all legal requirements for custom preferences are fulfilled.

Letter of Credit Processing

GTS risk management helps businesses to integrate export and import processes. You can integrate the Letter of Credit Processing with import/ export transactions. This will also reduce financial risks.

Restitution

It assists exporters to handle restitution processes. This confirms the fulfillment of all requirements for restitution payments.

Advantages of SAP GTS

The key benefits of SAP GTS are –

- Automation and streamlining of import/ export processes

- Reducing the IT maintenance costs

- Mitigates business risks

- Proper compliance with existing trade regulations

- Allows companies to leverage the trade regulations to their advantage

- Handling the supply chain and enhancing the communication between different stakeholders

- Using SAP GTS, expensive shipment delays at borders can be avoided

- Helps companies with their compliance requirements and customs clearance processes

- Lowers the compliance issues and accelerates the export/ import processes

- Helps in auditing, where company officials can attach export/ import permits to GTS declarations

- It can be easily set up with an ERP system for handling trade issues

SAP Global Trade Services (GTS) Customers

Companies using SAP Global Trade Services (GTS) are –

- John Deere GmbH and Co. KG

- Mann+Hummel · Durr Systems GmbH

- BIOTRONIK · SGB-SMIT GmbH

- Tech Data Corporation

- The ALDO Group Inc.

- Stanley Black & Decker, Inc.

The major industries that use SAP GTS include -

- Information technology

- Aviation & aerospace

- Pharmaceuticals

- Computer software

- Medical devices

Conclusion

In 2016, the U.S. Customs and Border Protection Automated Commercial Environment (ACE) for Entry Summaries certified SAP GTS. It became the first ERP software to get this certification. From then onwards, the software has been benefiting companies worldwide. This way, companies have enhanced their income and established better trade relationships.