The Finance Ministry of India introduced the TDS system aiming to collect taxes from the very source of income. According to the financial year, the amount of TDS gets collected in an individual's Form 26AS.

But when a business pays Google or Facebook ads for advertising their product, under section 194C of the income tax act, they need to deduct TDS. To proceed with this step, one must first check whether they fall under section 194C.

This article is an ultimate guide that will provide you with all the steps and directions to complete the procedure to claim the TDS refund from Google in India.

What is TDS?

TDS, short for tax deducted at source, is a direct taxation mechanism, a notion of collecting taxation intended from the very source of income. The deduction of TDS depends on per specified by the tax department.

The business or individual who concludes the final payment after deducting TDS is called the deductor. And the third party or individual receiving the final payment after the TDS deduction is known as the deductee.

What are Google Ads?

Google acts as a business platform that boosts promoting business, selling services or products, increasing traffic to a website, etc. It is the name of Google's pay-per-click (PPC) platform, a system where the advertiser bears a cost to Google each time end-users use links or click one of their ads.

One of the most typical Google Ad ads is the search ads. It appears on the search engine results page (SERP) to advertise the advertiser's services and products during the search pertinent. Also, businesses can use this platform called Google Ads to run "shopping ads," "display ads," "YouTube ads," and many other related ads.

According to the system, when one individual business makes payments to another business partner or individual, they are accountable for deducting TDS from the amount paid to the recipient and paid to the government. The recipient would receive the remaining amount after paying the government.

How to submit a TDS refund request to Google India?

The following steps will direct you to the procedure for applying and claiming a TDS refund for Google ads in India:

- First, an individual should make a complete payment for their Google Ads invoice to Google. They should add the TDS amount.

- Then, they need to calculate the TDS amount, i.e., two percent for Google Ads, and pay the government. According to this TDS amount, they should file the TDS returns. Also, use this PAN Number of Google, i.e., AACCG0527D, during the filing process.

- Open the Income Tax website and they need to download the TDS certificate, i.e., FORM NO. 16A. The FORM NO. 16A is a certificate that implies the amount of tax at source deduction.

The policies of the TDS Certificate submission:

Businesses can issue their TDS refunds only if they are no longer using their Cloud Billing account or have canceled their account. One can contact Google Cloud Billing Support for a refund; directly by clicking the Cloud Billing case.

An individual needs to submit a TDS certificate to Google, and they can get credit for the amount deducted. According to every financial year and the timeline prescribed in the relevant Indian tax law, one must submit the TDS certificates every quarter.

They should issue their TDS Certificates for each quarter completed in June, September, December, and March, by July 30th, October 30th, January 30th, and May 15th, accordingly. But if an individual sends their previous financial year's TDS certificates, the policy will not accept them if sent after May 31st of the ongoing financial year.

How to calculate the deduction of TDS and pay Google?

One must not include the GST amount while calculating the TDS amount. Business holders should calculate the total TDS amount only on the precise invoice amount, barring the GST amount.

Follow the given steps to claim the TDS refund in the next section by submitting FORM 16 / 16A to Google. The present rate of TDS for payments for advertisements to Google India Private Limited is two percent, excluding GST.

How to Calculate TDS Amount example:

Subtotal in INR: 10000

GST Amount in INR: 1800

Total Amount in INR: 11800

TDS Amount in INR: (10000/100) * 2 = INR 200

TDS for Google Ads: 2% excluding GST

(per Circular No. 23 of 2017 dated July 19, 2017 issued by the Central Board of Direct Taxes, Ministry of Finance, and Government of India)

Instructions for claiming the TDS refund and submitting the FORM 16 / 16A to Google:

After completing the process, one can get a refund from Google for the TDS amount as Ad credits to the same Google Ads account. Here is a step-by-step procedure to submit and claim a TDS refund for Google Ads:

Step 1: At first, one must verify that they are using the same Google account that matches the Google Ads account that directs to the TDS refund.

Step 2: Go to the Google Ads help page by clicking here. https://support.google.com/google-ads/answer/2375370?hl=en

Step 3: The previous step will direct you to the Google Ads help page, then select the country from the dropdown list. If an individual has previously logged in to the Google Ads account, it will automatically select the country by default. Since in this article, we discuss claiming a TDS refund for Indian Google Ads accounts only, you can apply these steps only to the country of India.

Step 4: Scroll down and explore the page. You will get the text under the heading "Sending Tax Deducted at the Source (TDS) certificate." Read the paragraph, and you will notice a "by email" link that will direct you to this. https://support.google.com/google-ads/answer/2375370?hl=en

Direct Link: https://support.google.com/google-ads/contact/billing_none

Important NOTE:

The link may not work if you directly try to open it. It will misguide you to other unnecessary help supports.

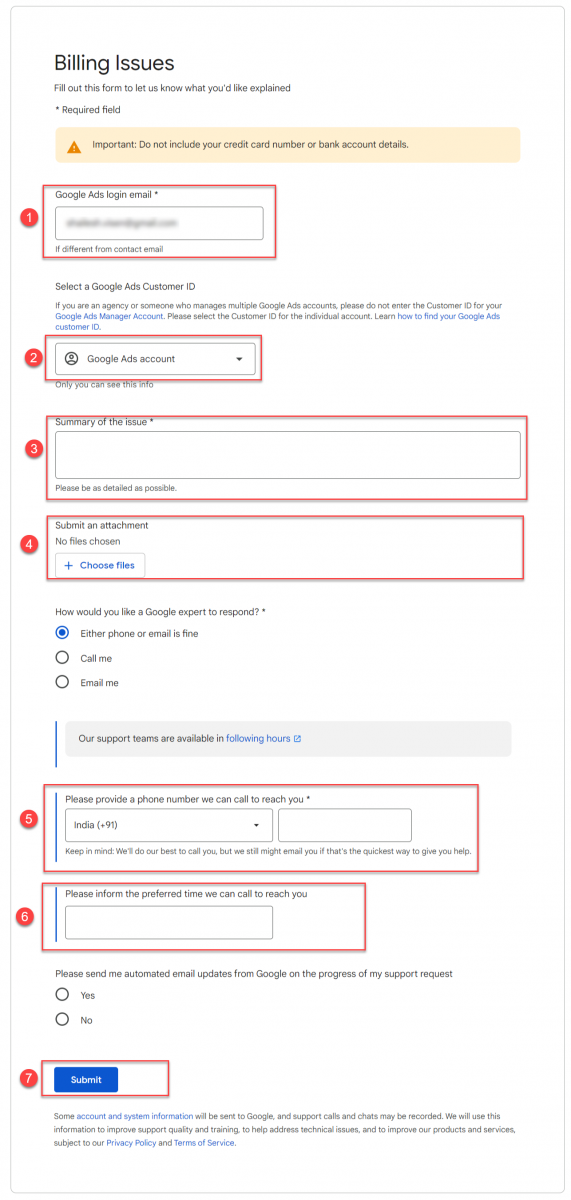

Step 5: The above step will direct you to the next page, "Billing Issues." Seeing the page title, one might think that this page is misguiding, but you are in the right location for further procedures. From there, one can claim their TDS refund from Google Ads.

Step 6: In the email login email option, add the correct Email Address. You should log in using the Google account, the same as the Google Ads account discussed above. The Google team will prepopulate this connection through the correct email address correctly for you.

Step 7: Next, you must choose the correct Google Ads account from the dropdown list. Multiple email accounts can create confusion, so you must select the account correctly.

Step 8: After selecting an account for the TDS refund, an individual can fill out a "Summary of the issue." Here, you simply need to enter a few statements stating something like this: "I have filled in my Google Ads account for the TDS refund with the right TDS amount. Can this help me to get my TDS refund?"

Step 9: In this step, you will find some texts written "Submit an attachment," where you add the required files for the TDS refund. Remember, you should attach all the TDS certificates (FORM 16A) without any miss. But do not submit very old certificates, or else Google might reject them.

Step 10: Lastly, click the submit button for the final submission. Now, you will receive an automated email from Google mail id "ads-support@google.com" following the below texts:

"We've opened a case for you

Thanks for reaching out.

Our team will begin working on your support request right away, so you won't have to do anything else—you'll be sure to hear from us as soon as we have an update. You can find the case ID for your request in this email's subject line. In the meantime, please feel free to check the Google Ads Help Center for answers to your questions.

Thanks for advertising with Google! We look forward to helping you.

Sincerely,

The Google Ads Team"

Conclusion:

If an individual wants to know how to get their TDS refund from Google, this article will fulfill their wishes. They will get all the knowledge they should know before submitting a request for their TDS refund from Google Ads.