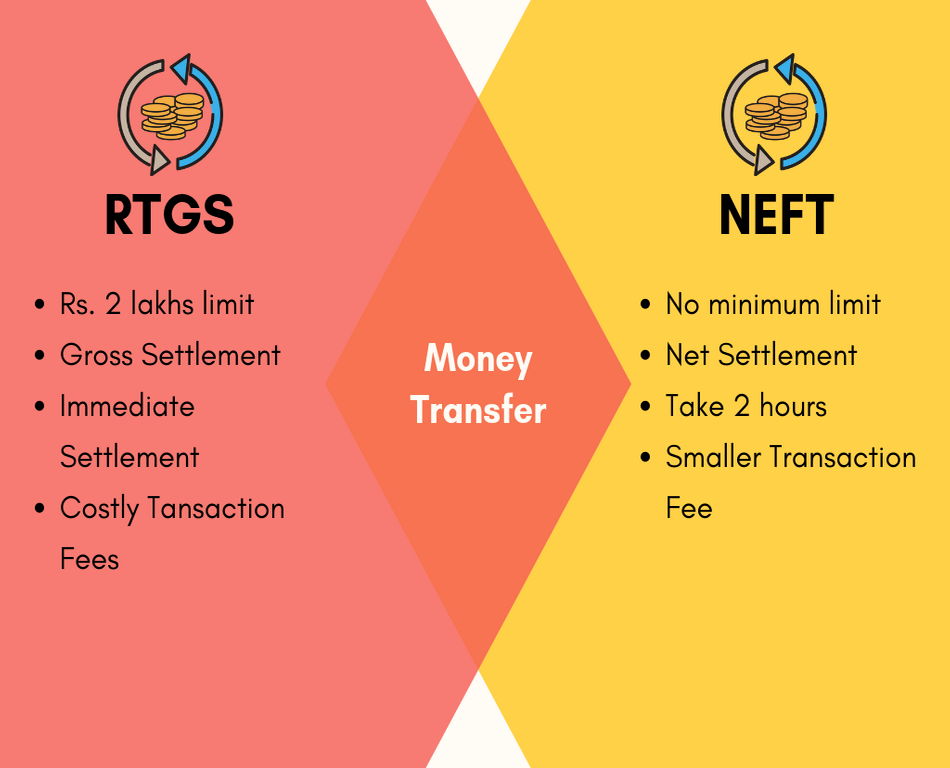

Have you been asking around for the best inter-bank transfer services from your colleagues and those related to banking channels? In general, interbank transfer refers to a particular banking service that helps people send funds through electronic means to Indian bank accounts. There are two ways of going about the act – RTGS and NEFT. This article aims to throw light upon these two means of electronic inter-bank transfer systems to help you decide the way forward in different circumstances.

RTGS vs. NEFT

| RTGS | NEFT |

|---|---|

| Rs. 2 lakhs is the minimum permissible amount of RTGS | There is no minimum limit on the amount of remittance under NEFT |

| No upper ceiling on the amount of maximum payment (the maximum amount for each transaction being restricted to Rs.50,000/- regular and cash-based payments to Nepal) | No high limit on the amount of maximum remittance (the maximum amount for each transaction being limited to Rs.50,000/- regular and cash-based remittances to Nepal) |

| RBI Settlement Timings for all RTGS transactions (excluding Inter Bank Transactions): Monday through Friday - 09:00 hrs to 16:30 hrs Saturday - 09:00 hrs to 13:30 hrs |

Currently, NEFT transactions take place in hourly batches. There are 12 RBI settlements: Monday through Friday - 08:00 hrs to 19:00 hrs Working Saturdays - 08:00 hrs to 19:00 hrs 2nd & 4th Saturdays – No transactions |

| RTGS is carried out immediately and is based on gross settlement. Gross settlement refers to a transaction that is completed on a one-to-one basis. It is not bunched with other transactions. | NEFT is based on net-settlement. Deferred Net Basis (DNS) or net-settlement refers to a transaction that is completed in batches and at specific times. In the case of NEFT, all transfers are likely to be held up until a particular time. This causes NEFT transactions initiated after the last cycle to be processed the next day. |

| Service / Processing Charges: (a) Inward Transactions: No charges are levied (b) Outward Transactions: Rs 2 lakh to Rs 5 lakh – Maximum of Rs. 30/- for each transaction Above Rs 5 lakh – Maximum of Rs.55/- for each transaction |

Service / Processing Charges: (a) Inward Transactions: No charges are levied for credit to beneficiary accounts at destination bank branches (b) Outward Transactions applicable to the remitter at the bank branch of origin: Up to Rs 10,000: Maximum of Rs 2.50 (plus Service Tax) Rs 10,000 TO Rs 1 lakh: Maximum of Rs 5 (plus Service Tax) Rs 1 lakh to Rs 2 lakhs: Maximum of Rs 15 (plus Service Tax) Rs 2 lakhs plus: Maximum of Rs 25 (plus Service Tax) |

| RTGS transactions involve big amounts of cash. A minimum of Rs 200,000 may be transferred through this system. It is a better means of electronic funds transfer to use in an emergency. | NEFT transactions may be of any amount below Rs 200,000. It is used for transferring smaller value amounts. |

| Speed of settlement: Immediate | Speed of settlement: 2 hours (subjected to cut-off timings/ batches) |

| Both the sender's and beneficiary’s account have to be RTGS-enabled. Though most Indian banks are participants in the RTGS transfer network operated by RBI, eligibility of the access to the RTGS payment system has to be verified for specific banks. | NEFT transactions can be settled and initiated from the sender’s bank account to any other bank account across India. |

| Costly transaction fees due to faster settlement speed and transfer conducted on a one-to-one instruction basis. | A smaller fee applies to NEFT transfers, and individuals can carry out online fund transfers in a cost-effective way. |

| RTGS transactions can be done online and via bank branches. For online transactions, the bank will charge up to Rs. 10 + GST. Rs. 56 is chargeable for RTGS transactions done via the bank branches. | NEFT can be availed at the bank branches and online. The NEFT transaction charges will be different in either case as per specific bank branch policies. |

What is RTGS?

RTGS is best defined as continuous fund transfer, with its settlement taking place in real-time. In other words, if you opt to transfer your funds via RTGS, then the amount specified will be moved on a gross basis (on a one-to-one basis and not clustered with any other transaction) from one bank to another in real-time. Here, the term real-time means that the movement of funds is not subjected to any waiting period and takes place instantaneously. The RTGS can be done basis an order by order mode without netting (on an individual basis). It is considered to be the fastest means of moving funds electronically.

Full form of RTGS

RTGS means ‘Real Time Gross Settlement.’ An important point to note is that an RTGS transfer is permanent and final as the transaction reflects in the accounts of RBI (Reserve Bank of India) instantaneously. You can initiate an RTGS transaction only during a specified number of hours and on working days only. The banks with core banking features are exclusively eligible to conduct this transaction.

What is NEFT?

NEFT is defined as an electronic funds transfer mode that facilitates the movement of funds on a one-to-one basis – from and to any bank in India. NEFT transactions allow firms, corporations, and individuals to transfer funds through online means in a quick, transparent, and secure manner. The transfer of funds can take place from the sender’s account to that of the recipient’s (beneficiary’s) bank account participating in the system. The recipient account may be in a different branch of the same bank or any other bank branch in the country.

Full Form of NEFT

NEFT means "National Electronic Funds Transfer." This system of electronic fund transfer was launched in November 2005. All Indian banks that are full members of RTGS are a part of the NEFT system as per the directive issued by RBI post the discontinuation of the SEFT (Special Electronic Funds Transfer System) clearing system in January 2006.