Before we delve into the difference between tax invoice and retail invoice, it is essential to understand the meaning of invoice, retail invoice meaning, etc. Through this article, we aim to explain invoicing meaning and difference between retail invoice and a tax invoice in a lucid and free-flowing way. Read on to take a closer look; we shall begin with a comparison chart that effectively depicts the difference between bill and invoice.

Invoice vs. Bill

| Basis of Difference | Invoice | Bill |

|---|---|---|

| Definition | An invoice refers to a document that is used for listing the purchased products, their quantities, and prices, etc. | A bill refers to a document that’s handed over by sellers to buyers, and they serve as requests for payment. |

| Handed to | Invoices are handed over by sellers to buyers; this handing over can take place before or after the products/services have been provided. | Bills are presented at restaurants, car service firms, credit card companies, supermarkets, shops, and other product/service providers. |

| Payment time | Unless the payment has been made in advance by the buyer, an invoice serves as a reminder for the pending amount of goods. The amount may or may not be made immediately. | A bill is presented to buyers with the expectation that all due payment is made immediately and in full. |

| What is recorded | The invoice serves as a record of all items purchased, rather than a request for their payment. | The bill records the items sold, including the price of each item, the total cost to be paid for the goods and services, etc. (this includes taxes as well as all other service charges). |

| Utility | Invoice billing is generally sent along with the goods shipped to customers by companies like Amazon, eBay, etc. Invoices may arrive along with the goods or after they arrive. | Bills usually include a pre-defined deadline for payments to be made, especially to goods purchased online. |

| Basic feature | In case the invoice bill arrives later, then it serves as a record of items as ordered so they can be cross-checked when the contents of the shipment reach the buyer. | In case a corporation or person fails to pay for the goods or services so purchased, different collections of companies may be appointed for collecting the funds that are due. |

What is an Invoice?

As per Investopedia, an invoice refers to a type of commercial document which is used for itemizing a transaction that takes place between a seller and a buyer. It specifies the conditions of purchase of goods and services in case the sale takes place on credit.

Besides, all available methods of making payments are depicted on the sales invoice. It contains the issuer's name, contact details, and address, terms of payment, account number and IFSC code along with bank branch details, etc. An invoice would also contain a number that is like a crucial unique identifier about the issuer. This unique identification number is referred to in all future correspondence.

As per Quickbooks, accounting software, an invoice is used by corporations and businesses that are desirous of collecting customer payments. The invoices are sent out to buyers so that they can be made accountable for the products and services sold to them. It is quite common or the recipients of invoices to refer to them as bills, though they are necessary records of payments.

In general, the bill invoice is dispatched before, along with, or after the buyers have received the products. They are usually sent once the goods/ services have been shipped/performed. These days, it is commonplace to find paper-based invoices being replaced by electronic ones. Invoices are like individual sales transactions that are designed to comprise statements of customers’ accounts partially.

What is a Bill?

A bill best describes transactions for goods/ services and the amount owed to vendors. In most cases, it is in the form of an invoice that a customer is expected to pay as soon as the same is presented to him or her, for example, the bill served to customers after the meal has been consumed. It is, in its purest form, a list that might have details that are not as important for invoicing purposes. In most cases, the demand is for immediate payment though it may be otherwise as well.

Bills are like documents receivable from vendors. They are a record of expenses, costs, or inventory and serve as records of the amount owed by a business or individual to a vendor, with the amount payable being mentioned on the face of the bill. Bills may have different statuses attached to them – pending, draft, or sent – in the case of accounting and invoicing software, especially when it comes to an understanding of what invoice bill is.

Business Dictionary describes a bill as a document that evidences one party's indebtedness to that of another. It is usually presented at restaurants, credit card companies, car service firms, supermarkets, product/service providers, and shops. It records the products/ services sold/ rendered, the price of individual items, the total amount that has to be paid along with services charges and related taxes, etc. In case the bill is left unpaid after an individual or corporation has been served with the same, then debt collection companies may be put into action to collect the due funds at the earliest. In the case of goods purchased online, the bills issues may have a deadline inscribed on them.

What is a Sales Receipt?

A sales receipt is issued for the goods/services rendered right at the time of their purchase taking place. In other words, sales receipts are presented to customers after a "point of sale" purchase or in case the buyers make immediate payment.

What is a Statement?

A statement depicts the status of a specific customer's account at any particular point in time. The statement is used for representing sales transactions, payments, credits in every line item for any given period. Though a statement is not as detailed as an individual sales transaction document, it is still quite useful for recording transactions for accounting purposes. A statement notifies customers about their standing and whether they still owe the seller any money or not. Statements are usually sent to customers on a consistent and regular basis.

Key Difference between an Invoice, Sales Receipt, Bill, and Statement?

- Invoice and bill serve to be commercial documents that are passed by sellers to their buyers once goods or services have been purchased or rendered; their delivery is complete; or at the time of the purchase order being made. So, what term will you use, invoice, or bill?

- An invoice lists out all the products that have been purchased, their quantities, exact prices as charged, the advance payments made, if any, etc. On the other hand, a bill is in the form of a document handed by sellers to their customers; they serve as requests for payment.

- Invoices are used as records for the transactions on the purchase of goods/ services. They may reach the customers’ hands before or after goods/ services are delivered/ rendered. They cannot be termed as immediate requests for payment. Conversely, bills are in the form of requests for immediate payment.

- An invoice, as received from suppliers, would showcase the items purchased, cost per unit, total cost/extension of things individually, as well as the total of all things as listed on the invoice’s face. On the other hand, a statement is a document from a supplier that contains the amounts owed on a specified date in past invoices as well. For instance, a statement might indicate that as on a specific date, a company owes the vendor payment for six invoices along with a small amount carried forward from an earlier invoice.

- The significant difference in context to invoice and receipt is that an invoice is issued before payment is made while a receipt is issued once the amount is complete. Invoices are generally used for tracking the sale of goods/services. On the other hand, receipts serve as documentation for buyers; they serve as proof that a specific amount has been paid for the purchased merchandise/services.

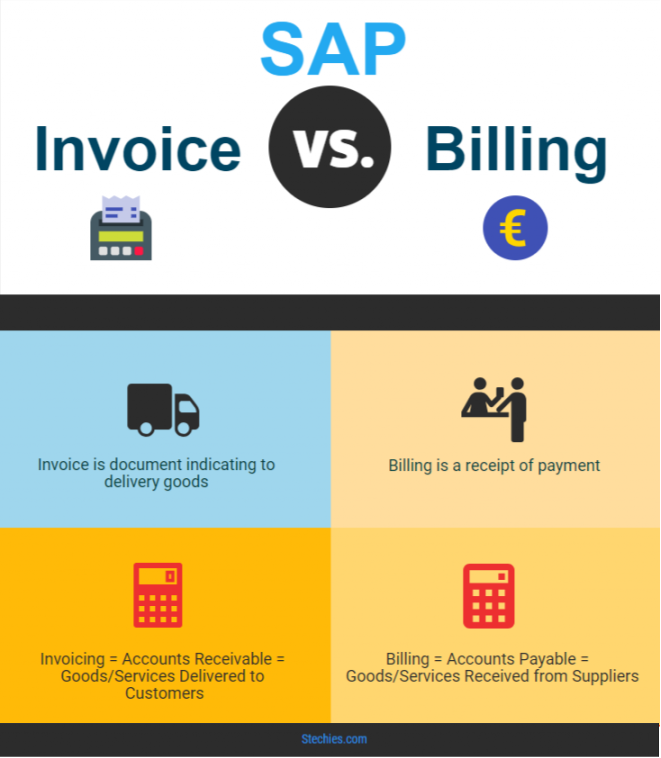

INVOICE vs. BILLING in SAP

Both are the same in the SAP SD point of view.

- In SD terminology we call as Billing Document and

- In FI terminology, we know as INVOICE.

- In MM again, the only INVOICE will be there for Vendors.

Invoice is a document indicating to deliver goods, and Billing is a receipt of payment.

When we receive the goods from vendors, we consider this a bill, but when we give the goods to the customers, we call it the invoice.

Bill means we have to pay the amount against the bill invoice means we have to receive the amount against the invoice.

Invoice is for both: Vendor Invoice and Customer Invoice.

Formula to Calculate Billing & Invoice in SAP

- Billing = Accounts Payable = Goods/Services Received from Suppliers.

- Invoicing = Accounts Receivable = Goods/Services Delivered to Customers.

Note: According to SAP Contract Accounting partner entity is allowed to be both or to switch between being creditor and debtor; therefore, bills and invoices may well apply to the same third party entities at different times.

Billing Tcodes:

- VF01 create a billing document. The delivery order comes up with an auto.

- VF02, the billing doc comes up an auto. View the accounting entries

Invoice Tcodes:

- FB60 Create an invoice concerning raw material and tax.

- FB70 Invoice entries for sales and tax

Conclusion

Now that you know the meaning of bills, statements, and receipts along with invoice definition, you will find it easy to understand the difference between bill and invoice, the difference between invoice and receipt, the difference between invoice and statement, etc. While the difference between invoice and bill is often merged and the terms are used interchangeably, the comparison between invoice vs. bill (as above), makes their meaning quite distinctive. In case you have any more inputs for billing and invoicing, what is meant by invoice, invoice, and bill difference, etc. we will look forward to hearing from you in the Comments section below. Please get back to us with you views on the bill vs. invoice.