In this SAP MM (Material Management) tutorial the SAP users will learn the step-by-step procedure to define a Tax Jurisdiction in the SAP system with proper screenshots.

What is Tax Jurisdiction in SAP?

The tax jurisdiction code is a key that with the tax code and various parameters determines the tax amount and the way in which payment of the entire tax amount will be divided between different tax authorities.

How to Define Tax Jurisdiction in SAP?

Please follow the steps below to define the tax jurisdiction in your SAP system:

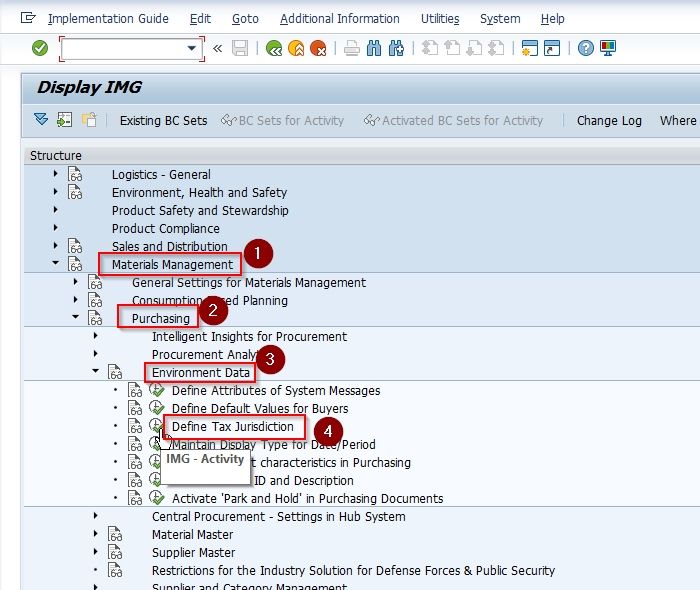

Enter t-code SPRO in the SAP command field and press Enter to execute the transaction code.

.jpg)

On the next screen click the SAP Reference IMG button to proceed to the next steps.

.jpg)

Now navigate to the following SAP IMG path:

SPRO > SAP Reference IMG > Material Management > Purchasing > Environment Data > Define Tax Jurisdiction

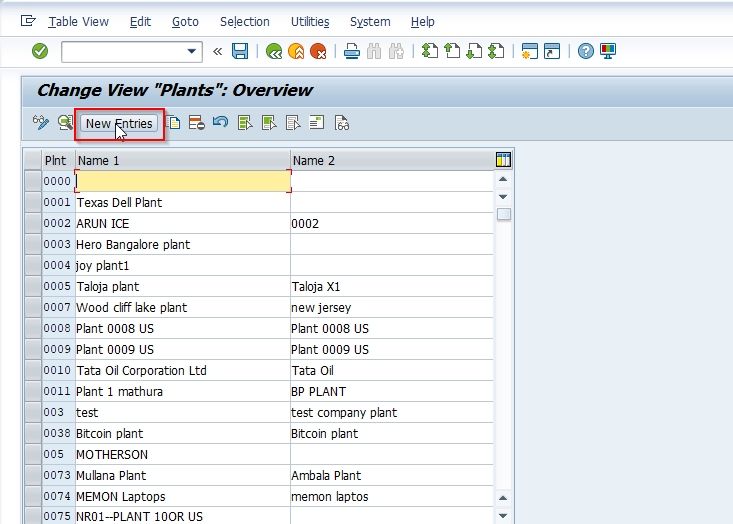

Next on the Change View "Plant": Overview screen you will see a list of all previously defined tax jurisdictions on your SAP system.

.jpg)

Next, click the New Entries button to define a new tax jurisdiction on your SAP system.

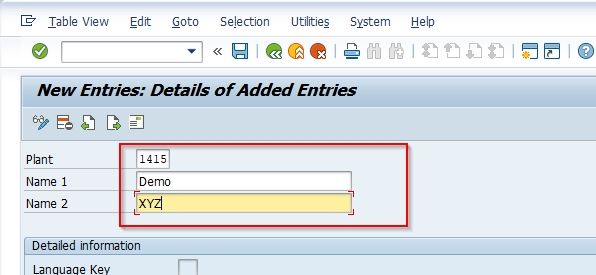

Now on the screen enter the following fields for the new tax jurisdiction:

- Plants: Enter the plant name for which you want to define the new tax jurisdiction

- Enter the address of the plant in Name 1 and Name 2

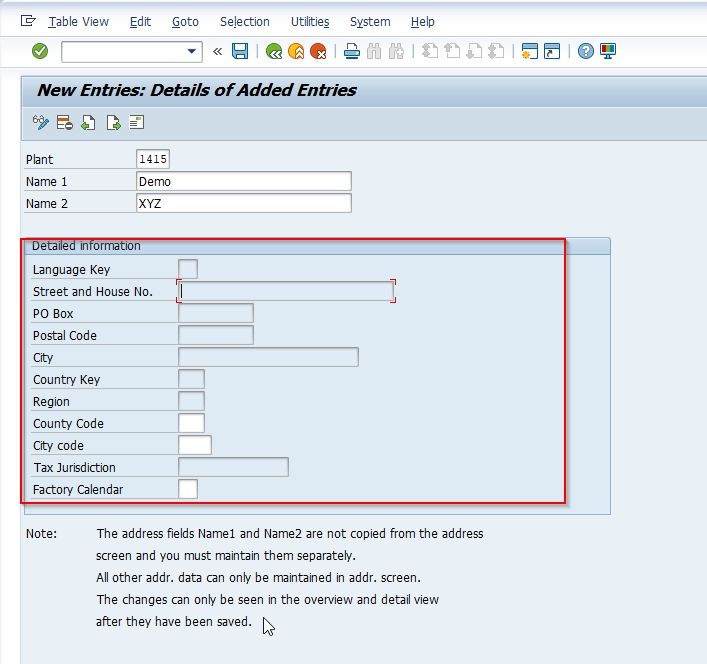

Next under the Detailed information section enter all the details according to your requirements

Once all the details have been entered click the Save button to save the newly defined Tax Jurisdiction.

.jpg)

Now select your Customization Request id and press Enter to go to the next screen.

.jpg)

Next, the message Data was saved will be displayed at the bottom of your screen.

.jpg)

You have successfully defined the new Tax Jurisdiction on your SAP system.