Posting period is a concept in SAP that is used to control the posting of financial transactions in a given fiscal year. Posting periods are defined as time intervals within a fiscal year during which certain types of financial transactions can be posted.

What is Closing Period?

The closing period is the time frame during which no goods receipts or invoices can be posted for a specific purchasing organization. It is typically used to ensure that all relevant transactions for a given period have been accounted for before moving on to the next period.

During the closing period, certain activities are restricted, such as posting goods receipts, creating purchase orders, or changing existing purchase orders. This ensures that the purchasing organization's accounts are accurate and complete for the period.

The length of the closing period varies depending on the organization's needs, but it typically ranges from a few days to a week. Once the closing period is over, the system automatically opens the next period, and transactions can be posted again.

Characteristics of the Closing Posting Period

The characteristics of a closing period in SAP MM are:

- No postings: During the closing period, no postings can be made in the system for the relevant purchasing organization. This includes goods receipts, invoices, or changes to purchase orders.

- Accurate financial reporting: The closing period ensures that all financial transactions for the period are accounted for and that financial reporting is accurate.

- Prevents errors: Closing periods help prevent errors in financial reporting by restricting transactions during the period. This ensures that all transactions are complete and accurate before the next period begins.

- Time-bound: The closing period is a time-bound process that occurs at the end of each financial period. The length of the period can be configured according to the organization's needs.

- Authorization controls: Authorization controls can be set up to restrict access to transactions during the closing period, ensuring that only authorized personnel can make postings.

- Carry forward balances: The system can be configured to carry forward balances from the previous period to the current period, ensuring that financial reporting is accurate and complete.

Steps for Closing Period

Here are steps for closing Period – MM FI-CO i.e

- MMRV - Allow posting to previous period

- MMPV - Close Periods

- OB52 - Change view "Posting Periods: Specify Time Intervals"

- OKP1 - Maintain Period Lock

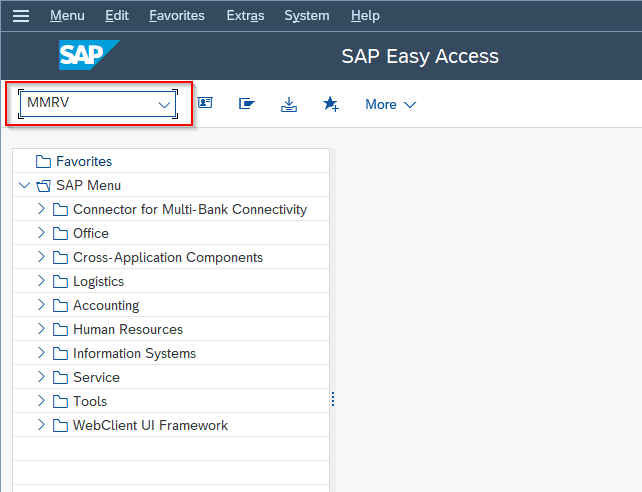

MMRV – View current period / Allow posting to previous period

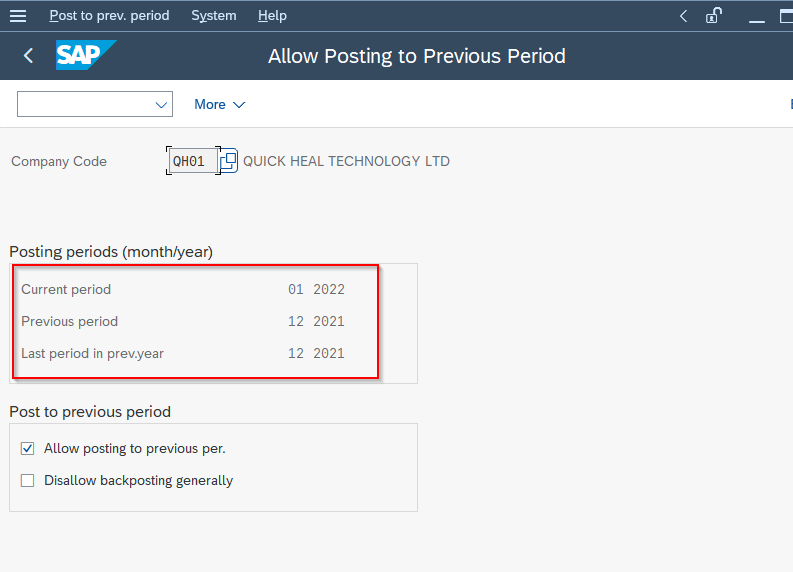

Using t-code MMRV, you can view the current period for posting and also change the settings to allow or disallow posting to a previous period.

- Go to transaction MMRV in the SAP Easy Access menu.

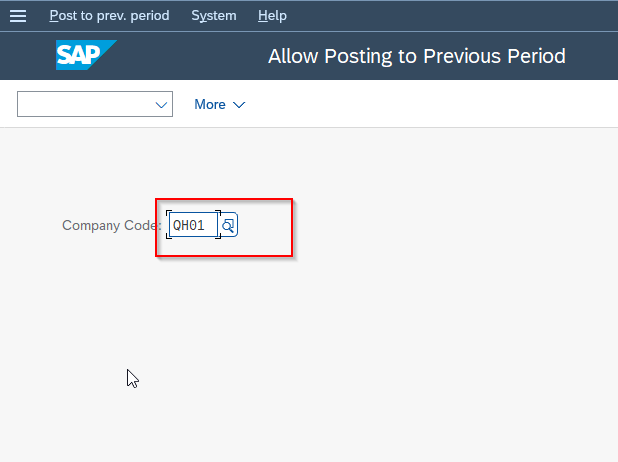

- Enter the Company Code for which you want to allow posting to a closed period.

- Enter the Posting Period for which you want to allow posting.

- Click on the Allow Posting to Previous Period checkbox.

.png)

- Click on the Save button to save the changes.

MMPV - Close Periods

In MMPV, you have the ability to perform period closing until the end of the current fiscal year. By executing the period closing program, the administrative record is updated, which ensures that the material master's stock data is also updated.

Suppose you wish to close periods up to 09/2023. In that case, you cannot post any values in 07/2023. If you still need to make postings in period t, you should only perform period closing for a maximum of t+1 period."

To use MMPV to close periods in SAP MM, follow these steps:

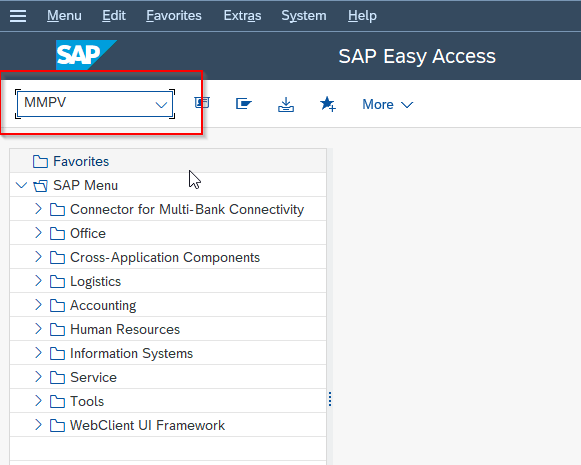

- Go to transaction MMPV in the SAP Easy Access menu.

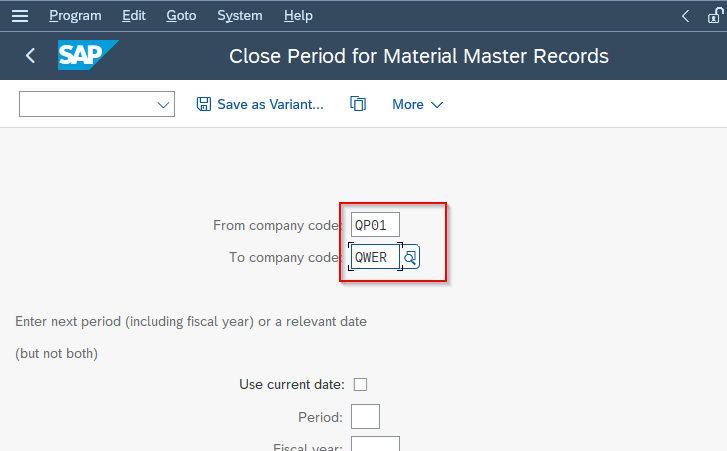

- Enter the company code for which you want to close the period.

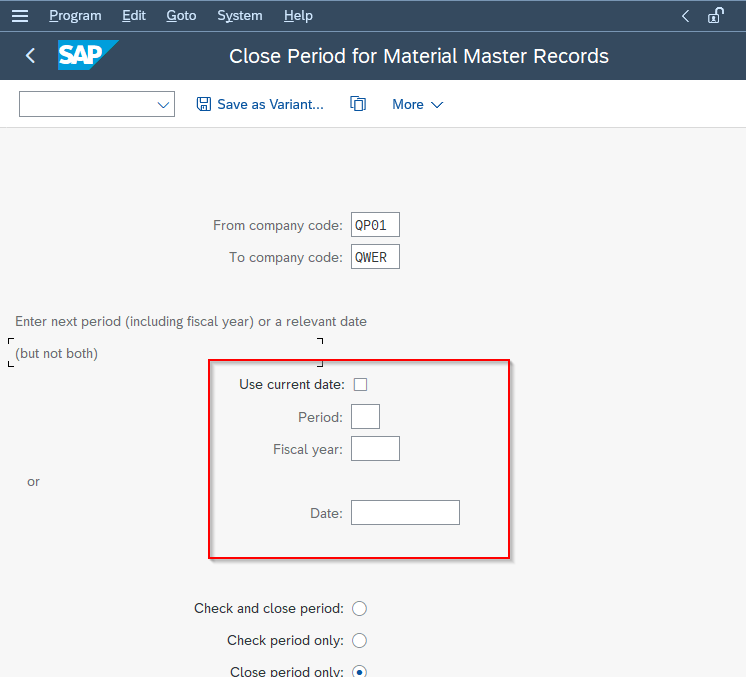

- Enter the period that you want to close.

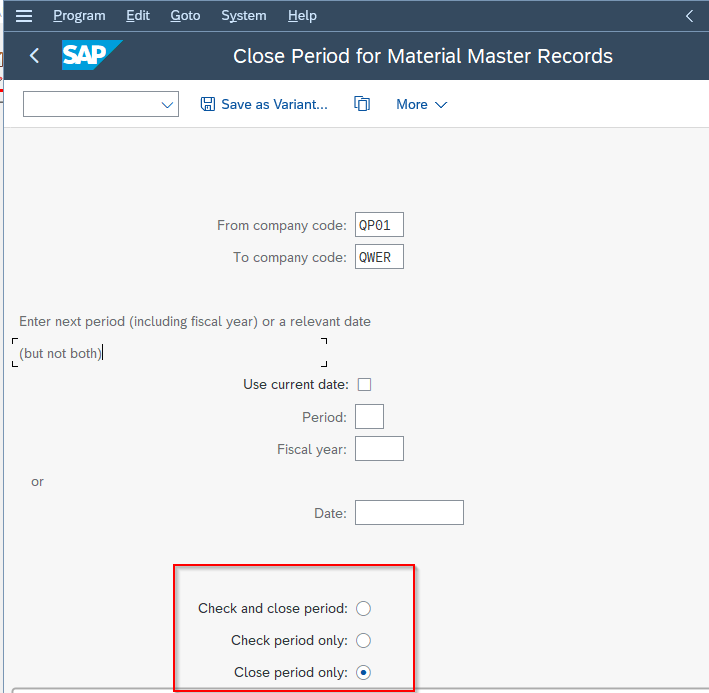

Next check the radio icon Close period only as shown in the below:

- At last click on the Execute button.

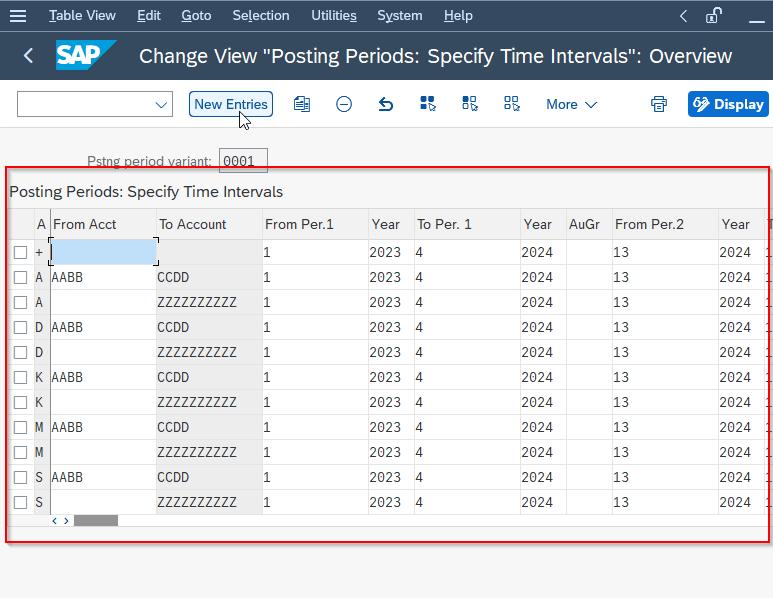

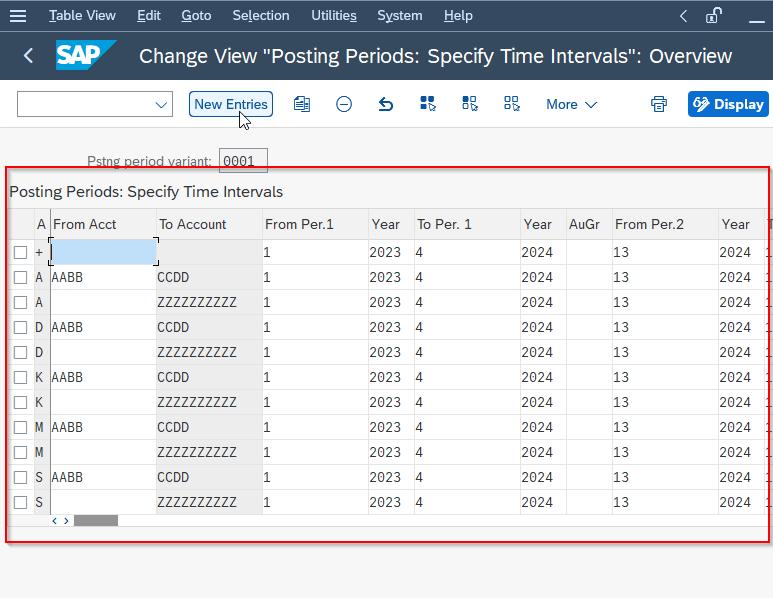

OB52 - Change view "Posting Periods: Specify Time Intervals": Overview

The OB52 is a transaction code in SAP that allows you to change the view for posting periods and specify time intervals for different fiscal years. This transaction is used by administrators or power users who are responsible for configuring and maintaining the system settings for posting periods.

When you enter the transaction code OB52, you will see the Posting Periods: Specify Time Intervals: Overview screen. This screen displays an overview of the time intervals for each fiscal year and allows you to make changes to the posting periods as needed.

In this activity, you close the posting periods for FI-AA and open the new periods for FI-AA. No more FI-AA postings can be made to the previous period. Postings for future periods are allowed.

Please follow the steps below to specify the time interval:

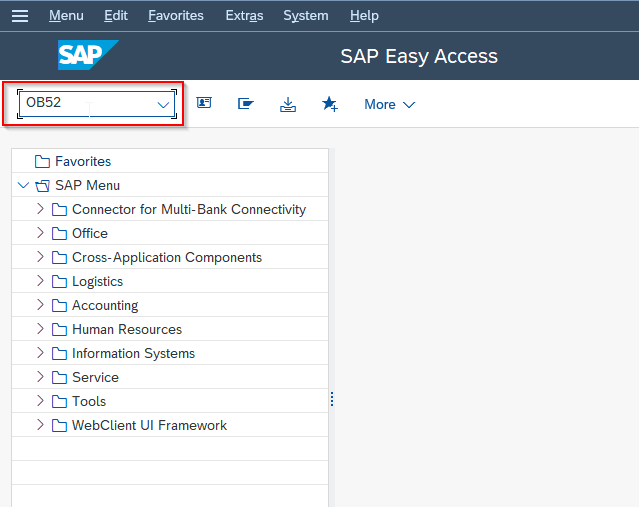

Execute transaction code OB52 in the SAP Easy Access menu.

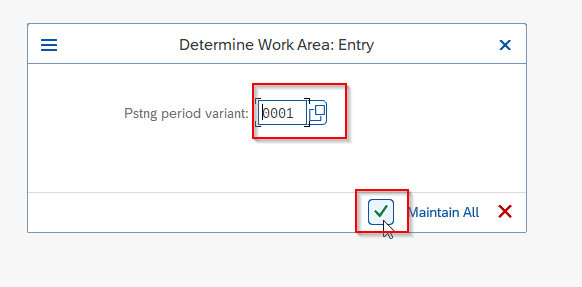

Select the Posting Period variant and press Enter.

Next on the Posting Periods: Specify Time Intervals: Overview screen you will see of the time intervals for each fiscal year.

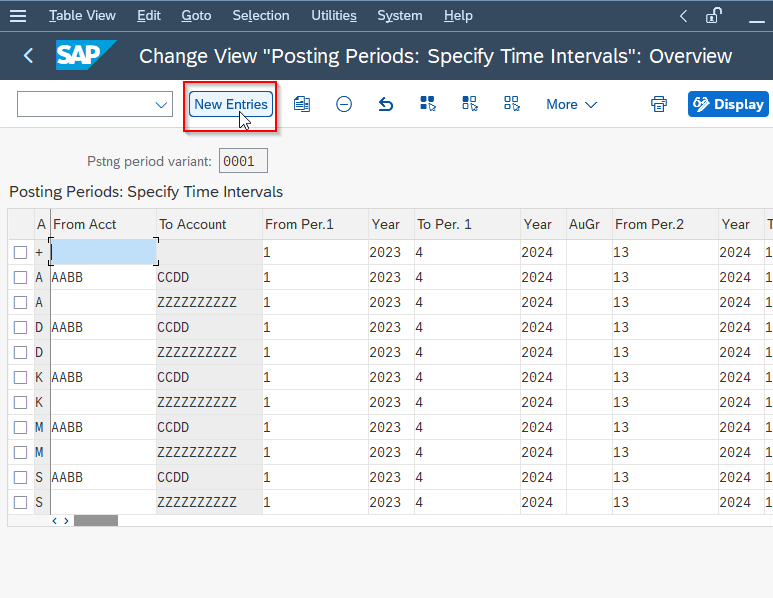

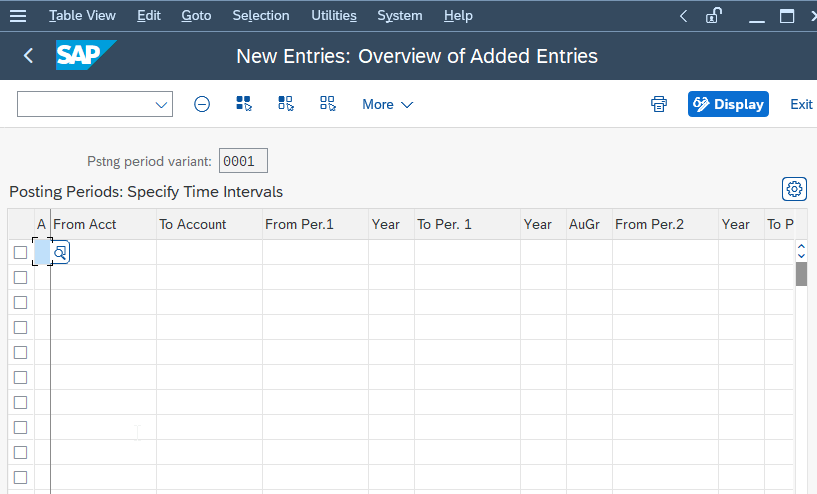

Click on the New Entries button to create new time intervals for the fiscal year.

Enter the details according to your requirements and make the necessary changes to the posting periods by entering new dates in the "From Period" and "To Period" fields.

If needed, update the short text for each posting period.

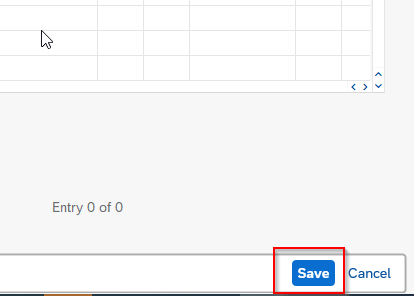

Save your changes by clicking on the Save button.

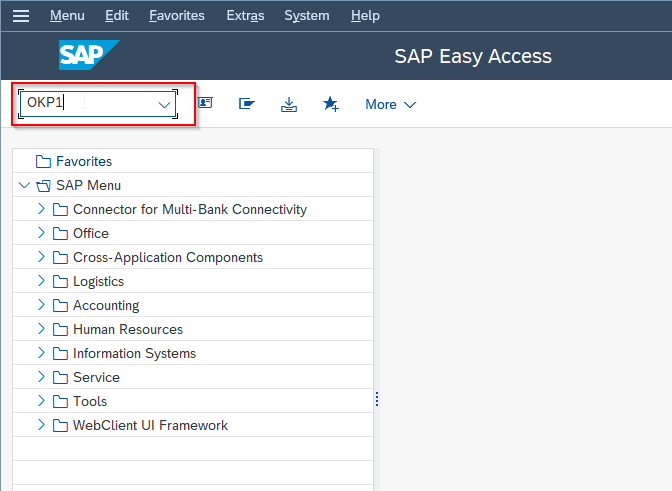

OKP1 - Maintain Period Lock

The t-code OKP1 in SAP is used to maintain period lock. The period lock is a feature in SAP that prevents users from making changes to financial transactions in a closed period. This is important to ensure the accuracy and integrity of financial reporting.

If needed, you can unlock the period for CO transactions.

To maintain the period lock in OKP1, follow these steps:

- Enter transaction code OKP1 in the SAP Easy Access menu.

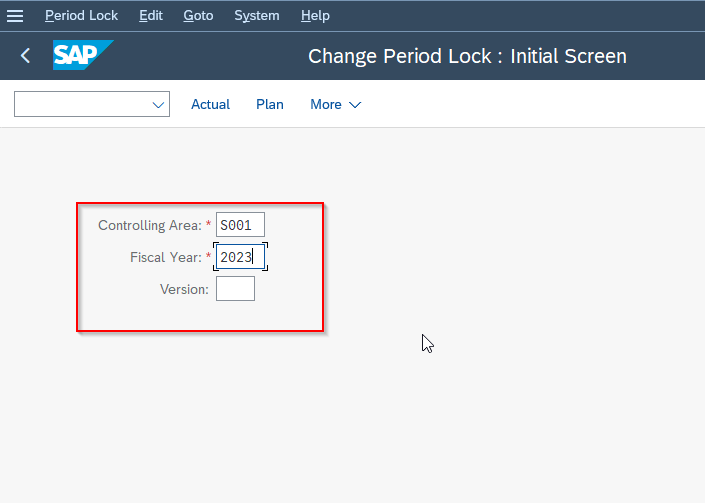

- Enter the Company Code and Fiscal Year for which you want to maintain the period lock.

- Next click on the Execute button.

.png)

- In the Maintain Period Lock: Oveeview screen, make the necessary changes to the period lock settings by checking or unchecking the boxes for the general ledger and other areas.

- If needed, update the user ID and date.

- Save your changes by clicking on the "Save" button

.png)

Conclusion

Once the posting periods have been closed, financial transactions for that fiscal year can no longer be posted or modified. However, in some cases, it may be necessary to allow posting to previous periods.

It is important to note that closing the posting periods should only be done after ensuring that all financial transactions for the fiscal year have been posted and that the financial statements for that year are complete and accurate.