What is Lockbox Processing?

The automated handling of incoming customer payments received through a Lockbox service offered by a bank is referred to as Lockbox processing In SAP S/4HANA.

This automated process streamlines the payment processing and enhance the efficiency of accounts receivable management within the organization. By utilizing Lockbox services and integrating them with SAP S/4HANA, companies can ensure accurate and timely application of customer payments while reducing manual effort and potential errors.

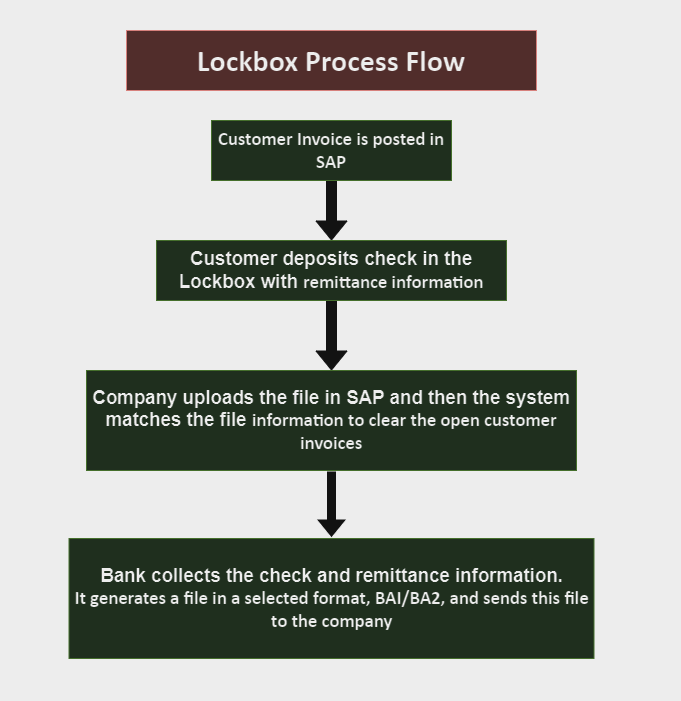

Lockbox Process Flow:

What is Lockbox?

The service offered by banks to facilitate the efficient handling of incoming customer payments is known as Lockbox. This service involves the creation of Lockbox accounts by companies at their affiliated banks. Customers can then send their payments directly to these Lockbox accounts accompanied by detailed remittance information specifying the corresponding open items that the payments are intended to clear.

Once the bank receives the payments, it compiles an electronic data file that contains payment advice data and customer payment amounts. This file is transmitted to the company, either through direct delivery or by the company retrieving it from the bank's secure file transfer protocol (sFTP) server.

Once the company receives the file, it uploads it into their SAP system for further processing and reconciliation.

.png)

Depending on the specific requirements of customers, some companies choose to establish a single Lockbox, while others opt for multiple Lockbox located at different sites to expedite the processing time.

The Lockbox processing functionality in SAP S/4HANA is configured to accurately interpret the file format received from the Lockbox service. This configuration ensures the customer open items are automatically cleared and accounting entries are posted in accordance with the predetermined configuration setup.

By leveraging this streamlined process, companies can achieve efficient and accurate management of incoming payments, optimizing their accounts receivable operations within the SAP S/4HANA system.

SAP supports two types of Lockbox format:

- BAI: It stands for Bank Administration Institute. It includes basic information such as –customer MICR, check amount and invoice number.

- BAI2: It is the most widely used and accepted format across banks and companies implementing SAP ERP. It includes detailed information such as – customer MICR, check amount, invoice number, payment amount per invoice, deduction amount per invoice, reason code (deduction)

What is the Purpose of Lockbox Processing in SAP S/4?

The main function of the Lockbox service is to allows the customers to send their payments directly to a designated post office box managed by the bank. The bank then collects the payments, processes them, and provides the payment details to the company.

The purpose of Lockbox processing in SAP S/4HANA is to automate and streamline the handling of incoming customer payments received through a Lockbox service provided by banks. SAP S/4HANA offers specific functionality and tools to seamlessly integrate Lockbox processing into the company's financial processes.

The key objectives of Lockbox processing in SAP S/4HANA are:

- Improves Payment Collection Efficiency: The Lockbox processing feature in SAP S/4HANA enables companies to efficiently handle and process customer payments. Through the automated handling of Lockbox files, the system speeds up the payment posting and application process, enabling faster and more accurate handling of customer payments. This streamlined approach enhances the efficiency of payment collection, enabling companies to manage their cash flow effectively and improve overall financial operations.

- Accurate and timely payment: SAP S/4HANA facilitates precise and prompt payment processing by automating the matching of customer payments with open invoices or outstanding items based on the information available in the Lockbox file. This automated process ensures that payments are applied accurately and promptly, reducing manual effort and minimizing the risk of errors.

- Real-time Visibility: Lockbox processing in SAP S/4HANA offers the company real-time visibility into the status of customer payments and the reconciliation process. This functionality enables the companies to actively monitor the progress of Lockbox processing, facilitating the identification of any exceptions or discrepancies. By promptly taking appropriate actions and resolving any issues, companies can ensure accurate and efficient payment reconciliation. This real-time visibility empowers organizations to effectively manage their payment processes, proactively address discrepancies, and maintain a high level of accuracy and efficiency in their financial operations.

- Optimize the Cash Flow Management: Lockbox processing in SAP S/4HANA significantly enhances cash flow management by expediting the processing and application of customer payments. Companies benefits from faster access to funds, resulting in improved liquidity management and informed decision-making. This accelerated payment processing empowers organizations to optimize their cash flow, efficiently allocate resources, and make timely financial decisions to support business growth and stability.

- Streamlined Reconciliation: SAP S/4HANA facilitates the reconciliation of Lockbox payments with the bank statement. The system automates the matching and clearing process, reducing manual effort and improving reconciliation accuracy.

- Integration with Financial Processes: Lockbox processing seamlessly integrates with other financial processes in SAP S/4HANA, such as accounts receivable, general ledger, and financial reporting. This integration ensures data consistency and provides a comprehensive view of financial transactions.

Benefits of Lockbox processing in SAP S/4HANA:

- It enables the companies to achieve greater efficiency, accuracy, and control over the payment collection and cash application process.

- It helps optimize financial operations, improve customer service, and enhance overall financial management within the organization.

Overview of the Lockbox processing steps in SAP S/4HANA:

- Lockbox File Creation: The Lockbox file is generated by the bank for each customer payment received containing information such as customer name, invoice number, payment amount and check number.

- File Upload: The Lockbox file is uploaded to the SAP S/4HANA system where it is processed using the Lockbox Processing functionality. This functionality in SAP S/4HANA supports a range of file formats, including BAI2, CSV, and XML.

- Lockbox Processing Configuration: The system requires configuration to map the lockbox file format to the corresponding fields in SAP S/4HANA. The configuration ensures that the system accurately interprets the incoming Lockbox data correctly.

- Lockbox Posting: Once the Lockbox file is uploaded and the system is properly configured, the Lockbox posting program is executed. This program reads the Lockbox file and creates payment documents in SAP S/4HANA. The payment documents can be in the form of customer incoming payments, clearing documents or open item postings depending on the business requirements.

- Payment Matching and Clearing: After the Lockbox posting, the system attempts to automatically match the incoming payments with open customer invoices based on the payment details. If a match is found, the system automatically clears the open items and updates the customer account accordingly. If no automatic match is possible, the payments are posted as unapplied or partially applied, and further manual processing might be required.

- Exception Handling: During the matching process if the system encounters any issues or exceptions with payment, these items are flagged as exceptions and need to be resolved manually.

For example, in case of duplicate payments or the payment amount not matching the invoice amount, manual intervention may be required to resolve the discrepancies.

- Bank Reconciliation: Once the Lockbox processing is complete, the next step involves performing the bank reconciliation process to reconcile the bank statement with the processed Lockbox payments in SAP S/4HANA.This important process ensures that the company's financial records accurately reflect the payments received.

SAP S/4HANA provides a range of tools and reports to monitor and analyze Lockbox processing. For example Lockbox status reports, exception reports, and cash application dashboards. These tools play a pivotal role in streamlining payment processing and enhancing the efficiency of the accounts receivable process within an organization.