Tax On sales / Purchases SAP 4.7

Configuration Steps

1. Check Calculation Procedure

2. Assign Country to Calculation Procedure

3. Check and Change Settings for Tax Processing

4. Specify Structure for Tax Jurisdiction Code

5. Define Tax Jurisdictions

6. Define Tax Codes for Sales and Purchases

7. Define Tax Accounts

1. Check Calculation Procedure

| Path | Img -> Financial Accounting -> Financial accounting global setting -> Tax on sales/purchases - > Basic Setting -> Check calculation Procedure |

| T Code | OBYZ |

In this activity , we will configure three sub activity:

Access sequence : In this sub step we will define the access sequence for determination price to considered as base value for various combination of plant / customer/ material.

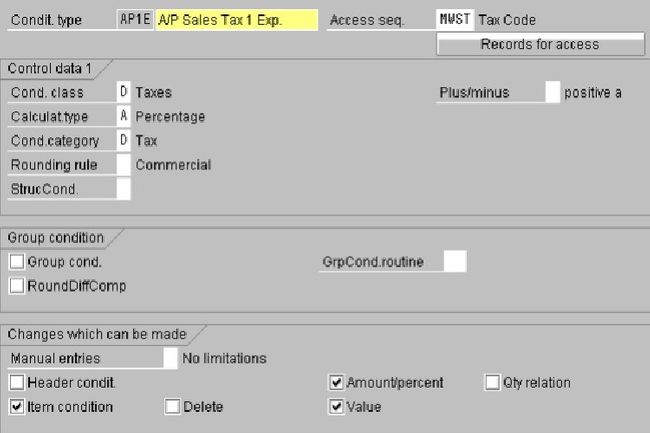

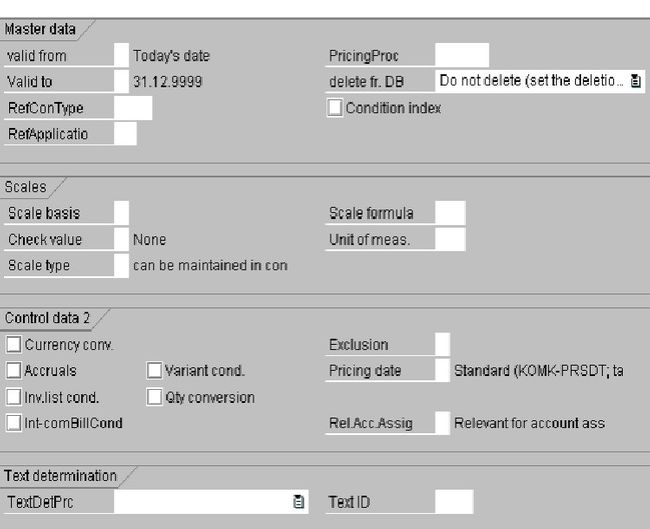

Define Condition type : In this sub step we will create different type of input tax / out put tax.

| Fields | Description | Purpose |

|---|---|---|

| Condit. Type | Condition type | The condition type is used for different functions. In tax for example, the condition type lets you differentiate between different kinds of tax based upon tax % nad tax type |

| Access Seq. | Access sequence | With the access sequence you define the condition tables used to access the condition records the sequence of the condition tables which field contents are the criteria for reading the tables |

Control Data 1

| Cond. Class | Condition class | Preliminary structuring of condition types e.g. in surchages and discounts or prices. Use : Allows standardised processing of individual condition classes within the system. |

| Calculat. Type | Calculation type for condition | Determines how the system calculates prices, discounts, or surcharges in a condition. For example, the system can calculate a price as a fixed amount or as a percentage based on quantity, volume, or weight. The calculation type can be set when generating new condition records. If this does not happen, the calculation type maintained here is valid for the condition record. |

| Cond. Category | Condition category (examples: tax, freight, price, cost) | A classification of conditions according to pre-defined categories (for example, all conditions that relate to freight costs). |

| Rounding Rule | Rounding Rule | The rule that determines how the system rounds off condition values during pricing. The last digit will be rounded. |

| StrucCond | Structure condition | controls whether the condition type should be a duplicated condition or a cumulated condition. This control is only helpful when you use bill of materials or configurable materials. A duplicated condition is duplicated into all assigned items. A cumulated condition contains the net value of all assigned items. |

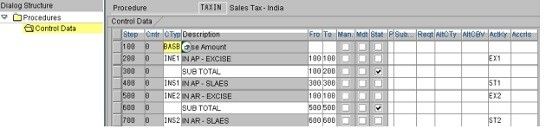

Define Procedure: In this activity we defined the steps for determination tax from base amount and various dependancies

2. Assign Country to Calculation Procedure

| Path | Img -> Financial Accounting -> Financial accounting global setting -> Tax on sales/purchases - > Basic Setting -> Assign Country to Calculation Procedure |

| T Code | OBBG |

In this activity, you enter the key for the calculation procedure, which determines the conditions which are allowed per document and which defines the sequence of the conditions in the document for each country.

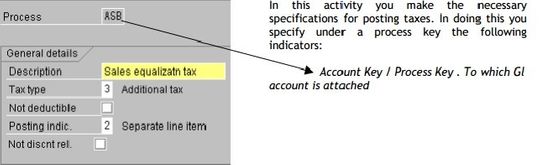

3. Check and Change Settings for Tax Processing

| Path | Img -> Financial Accounting -> Financial accounting global setting -> Tax on sales/purchases - > Basic Setting -> Check and Change Settings for Tax Processing |

| T Code | OBCN |

| Fields | Description | Purpose |

|---|---|---|

| Process | Internal processing key | The internal processing keys are used by the system to determine accounts or posting keys for line items which are created automatically. The processing keys are defined in the system and cannot be changed by the user. |

General details

| Description | Description of Processing Key |

|---|---|

| Tax Type | Output tax, input tax, additional taxes, or "not tax-relevant" can be specified as the tax type |

| Not deductiable | For this, tax amounts are marked as not deductible |

| Posting Indic. | Here you specify whether the tax amount is posted separately or distributed to expense or revenue items. |

| Not Discnt rel. | This indicator is set only for Canada. If you select it, the system does not take into account the corresponding tax amount when determining the tax base. |

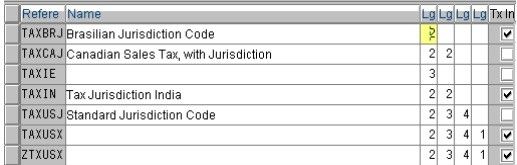

4. Specify Structure for Tax Jurisdiction Code

| Path | Img -> Financial Accounting -> Financial accounting global setting -> Tax on sales/purchases - > Basic Setting -> Specify Structure for Tax Jurisdiction Code |

| T Code | OBCO |

In this activity, you determine the structure of the tax jurisdiction code. This code is used for calculating taxes which are defined below the federal level (for example, US taxes, Canadian taxes).

The tax jurisdiction code can be subdivided into a maximum of four levels (for example, state/county/city/district). This way the tax rate is defined per level and the tax value is calculated individually per level.

If an entry exists for a calculation procedure, then tax processing for this calculation procedure is switched over automatically to the tax jurisdiction code method. In this activity you can also set whether taxes should be calculated at the line item or the "tax code/tax jurisdiction code" level.

| Fields | Description | Purpose |

|---|---|---|

| Refere | Country Reference | The country reference is a key that creates the reference to a country. |

| Lg | Length of the Nth Part of the Tax Jurisdiction Code | Length of the Nth Part of the Tax Jurisdiction Code |

| Name | Name of the Tax Jurisdiction Code Structure | Name of the Tax Jurisdiction Code Structure |

| Lg | Length of the Nth Part of the Tax Jurisdiction Code | Length of the Nth Part of the Tax Jurisdiction Code |

| Lg | Length of the Nth Part of the Tax Jurisdiction Code | Length of the Nth Part of the Tax Jurisdiction Code |

| Lg | Length of the Nth Part of the Tax Jurisdiction Code | Length of the Nth Part of the Tax Jurisdiction Code |

| Tx In | Determine taxes line-by-line | Taxes are determined on a line-by-line basis. A cumulative amount based on tax code or jurisdiction is not calcualted for internal tax information. This function is only activated if the taxes are calculated by the system during posting or simulation. Since multiple tax items can be created for each line item, and the maximum number of internal line items is 999, this maximum number of allowed items is, in effect, reduced, when compared to the lines allowed where line-by-line tax calculation is not activated. Line-by-line tax calculation is not supported for postings in external company codes! |

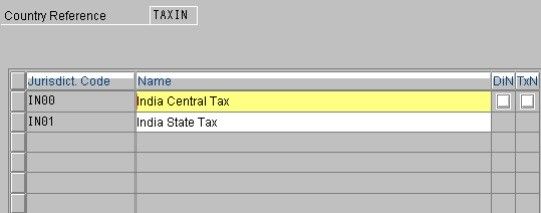

5. Define Tax Jurisdictions

| Path | Img -> Financial Accounting -> Financial accounting global setting -> Tax on sales/purchases - > Basic Setting -> Define Tax Jurisdictions |

| T Code |

OBCP |

In this activity, you specify the tax jurisdiction code per tax calculation procedure.

The tax jurisdiction code consists of up to four parts depending on the tax jurisdiction code structure for the relevant calculation procedure: the state code, the county code, the city code, and a local code component. The system uses these component parts to determine the tax rate for each tax authority.

| Fields | Description | Purpose |

|---|---|---|

| Jurisdict. Code | Tax Jurisdiction Code | The tax jurisdiction is used for determining the tax rates in the USA. It defines to which tax authorities you must pay your taxes. It is always the city to which the goods are supplied. |

| Name | Name of the Tax Jurisdiction Code Structure | |

| DiN | Discount base amount is the net value | Indicator with the effect that the sales tax is not contained in the base amount for discount calculation. Dependencies The rule that determines how the base amount for discount calculation is to be determined is subject to the relevant country legislation. Either the company code table or the jurisdiction code table is used for control purposes. If tax is calculated using the jurisdiction code, the entries in the company code table are invalid. Control then takes place at the highest level of the definition of the jurisdiction code. This method of tax calculation is used in America, for example. Example: In Germany, the possible discount deduction is first taxed when the document is posted. A tax adjustment is then made when the balance is paid. In this case, the base amount for discount calculation is gross, that is, it includes sales tax. |

| TxN | Base amount for tax is net of discount? | Indicator that causes the base amount for the calculation of sales tax to be reduced by the discount share. Dependencies The rule used to determine the base amount for the calculation of sales tax is subject to the relevant country legislation. Either the company code table or the jurisdiction code table is used for control purposes. If the jurisdiction code is used for tax calculation, the entries in the company code table are not valid. Control then takes place at the highest level of the definition of the jurisdiction code. This method of tax calculation is used in America, for example. Example: In Great Britain, the base amount for sales tax is the invoice amount less the agreed discount. Note: If the tax base amount is net, the net value also has to be chosen as the discount base. Exception: If tax is calculated using the jurisdiction code (USA), the combination 'Net tax base' and 'Gross discount base' is also permitted, however, no tax adjustment is made for payment with a discount deduction. Example : In the following an example is given for each possible combination. In each case, the material value is 100.00, the possible discount percentage 3.00 %, and the tax percentage 10.00 %. 1) Gross tax base, Gross discount base Tax base 100.00 ==> Tax amount 10.00 Possible discount amount (3.00 % of 110.00) 3.30 Invoice amount 110.00 2) Gross tax base, Net discount base Tax base 100.00 ==> Tax amount 10 |

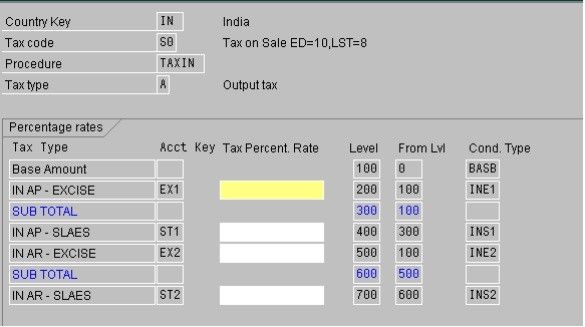

6. Define Tax Codes for Sales and Purchases

| Path | Img -> Financial Accounting -> Financial accounting global setting -> Tax on sales/purchases - > Calculation -> Define Tax Codes for Sales and Purchases |

| T Code | FTXP |

You have to define a separate tax on sales/purchases code for each country in which one of your company codes is located.

Each code contains one or more tax rates for the different tax types. If you have to report tax-exempt or non-taxable sales to the tax authorities, you need to define a tax rate with the value 0.

In this activity, we will define.

- Tax code , for a country and tax procedure

- Type of tax , whether the defined tax code is a out put tax or input tax

- Tax rate for condition type

7. Define Tax Accounts

| Path | Img -> Financial Accounting -> Financial accounting global setting -> Tax on sales/purchases - > Posting -> Define Tax Accounts |

| T Code | OB40 |

In this activity, you specify the accounts to which the different tax types are to be posted. The system determines these accounts for automatic postings.

In this activity we have to assign GL account no for each and every transaction Key/ Account key that has been assigned at check calculation procedure.

Note :

- Tax on sale or purchase code will be defined at account master control data tab. Here we can defined all tax code for input tax or output tax for tax procedure attached to country and company code or a single tax code.

- Tax procedure is attached to country not company code, and company code is attached to country. Hence tax procedure indirectly attached to company code.