Steps to create official withholding tax keys

Please follow the steps below:

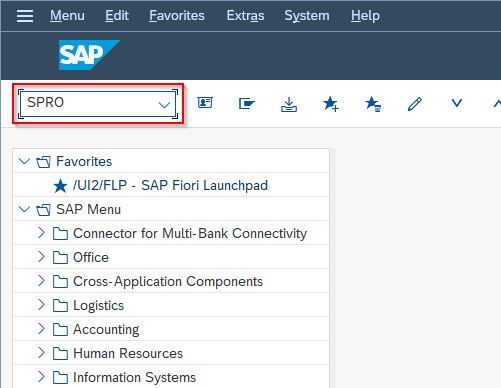

Execute t-code SPRO in SAP command field

Next, click the SAP Reference IMG button

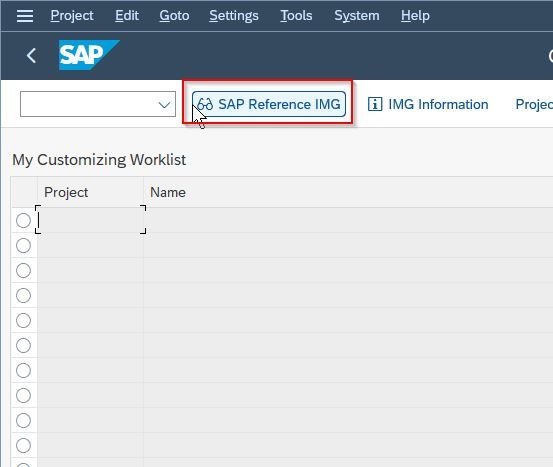

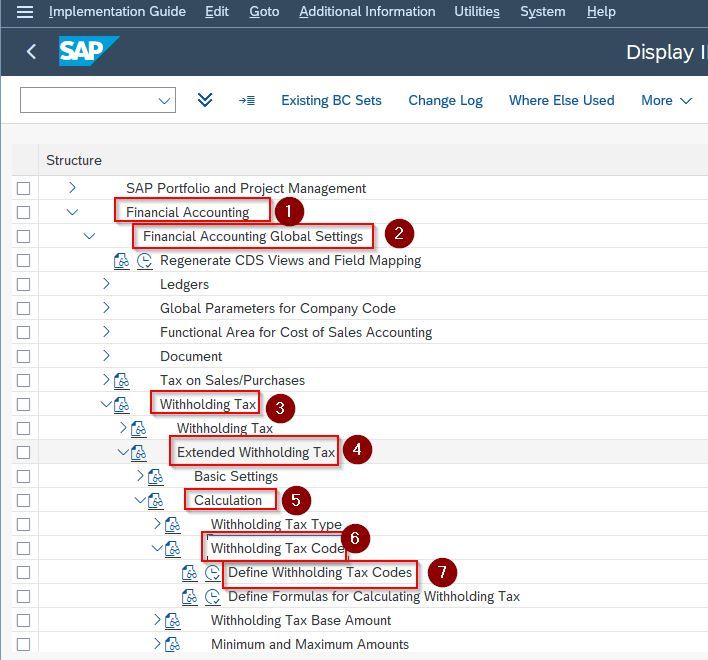

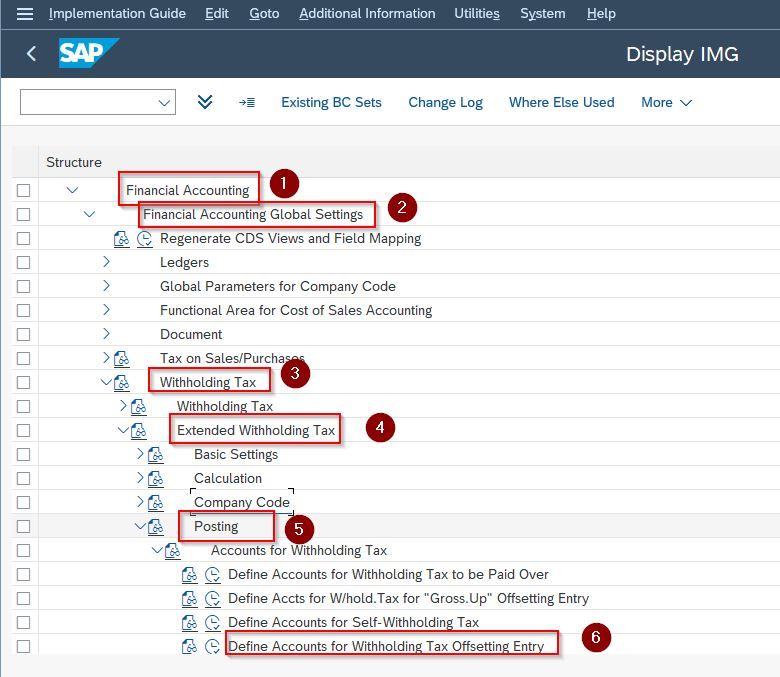

Now navigate to the following SAP IMG menu

Financial Accounting-> Financial accounting global settings-> Withholding Tax-> Extended withholding tax-> Basic setting-> Define Withholding Tax keys

.jpg)

Next, enter the Country key and press Enter to proceed

.jpg)

Now click the New Entries button

.jpg)

Create new official withholding tax keys for GST as shown below

.jpg)

Steps to create withholding tax type for Invoice Postings

Please follow the steps below:

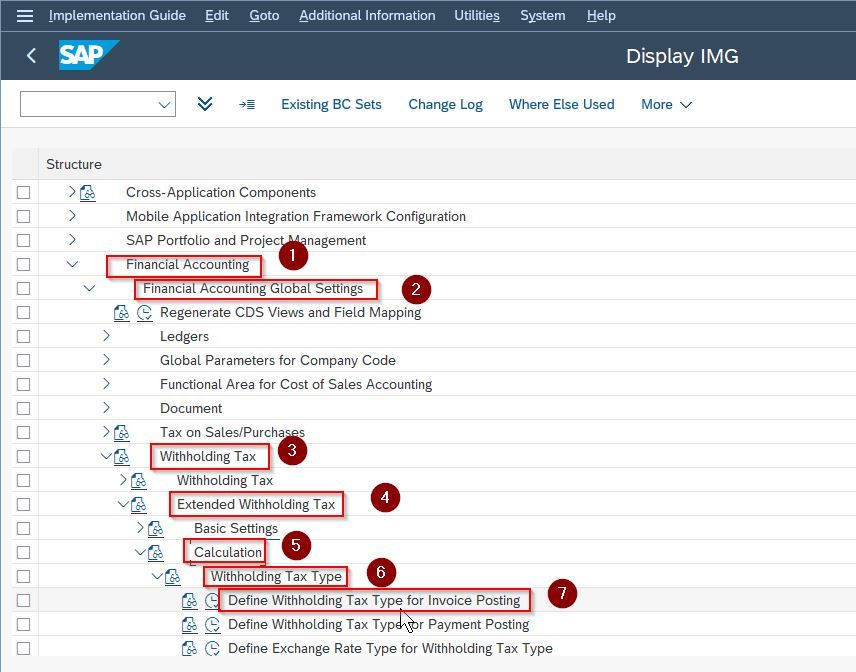

Navigate to the following SAP IMG menu

Financial Accounting-> Financial accounting global settings-> Withholding Tax-> Extended withholding tax-> Calculation-> Withholding tax type-> Define withholding tax type for invoice

Next, enter the Country key and press Enter to proceed

.jpg)

Now click the New Entries button

.jpg)

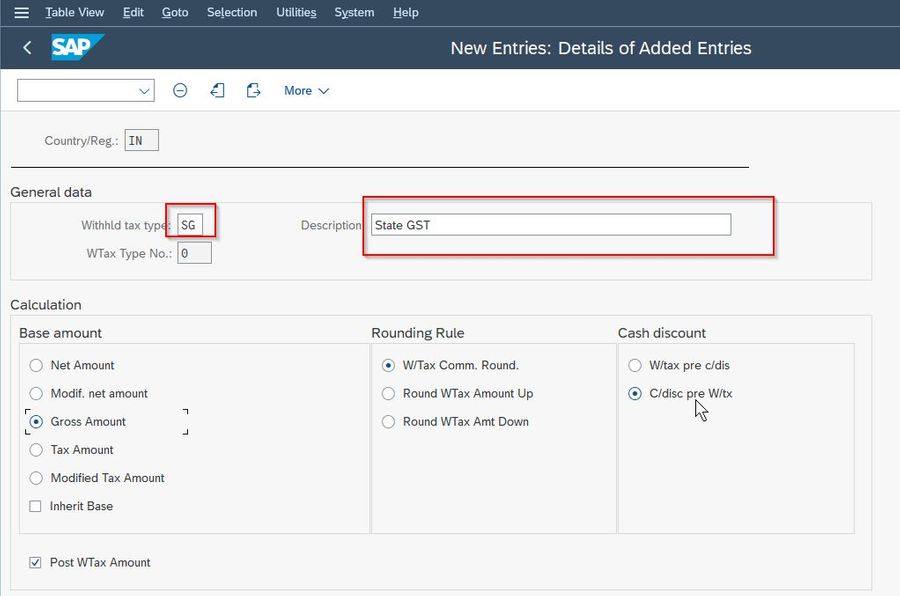

Create withholding tax type with the settings as shown in the screenshots below.

.jpg)

Similarly create Withholding tax types for CGST, IGST, UGST, and SGST.

.jpg)

Steps to create withholding tax type for Payment postings

Please follow the steps below:

Navigate to the following SAP IMG menu

Financial Accounting-> Financial accounting global settings-> Withholding Tax-> Extended withholding tax-> Calculation-> Withholding Tax Type-> Define Withholding Tax Type for Payment Posting.

.jpg)

Next, enter the Country key and press Enter to proceed

.jpg)

Now click the New Entries button

.jpg)

Create withholding tax type with the settings as shown in the screenshots below.

Similarly, create Withholding tax types for SGST, CGST, IGST, and UGST.

.jpg)

Steps to create withholding tax code

Please follow the steps below:

Navigate to the following SAP IMG menu

Financial Accounting-> Financial accounting global settings-> Withholding Tax-> Extended withholding tax-> Calculation-> Withholding tax codes-> Define withholding tax codes Enter country key as IN.

Next, enter the Country key and press Enter to proceed

.jpg)

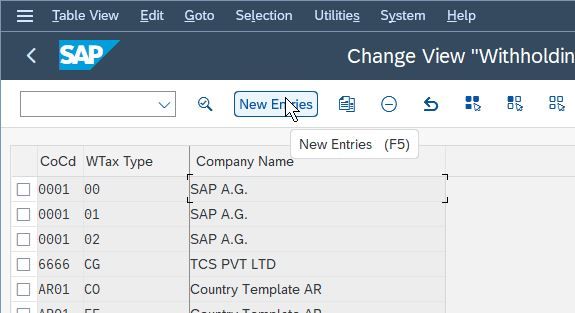

Now click the New Entries button

.jpg)

Create a withholding tax code with the settings as shown in the screenshots below.

.jpg)

Similarly, create a GST tax code for CG, IG, SG, and UG

Note: Maintain the With/tax rate as per business requirements.

Steps to assign the withholding tax type to the company code

Navigate to the following SAP IMG menu

Financial Accounting-> Financial accounting global settings-> Withholding Tax-> Extended withholding tax-> Company code-> Assign withholding tax types to company codes

.jpg)

Next, enter the Country key and press Enter to proceed

.jpg)

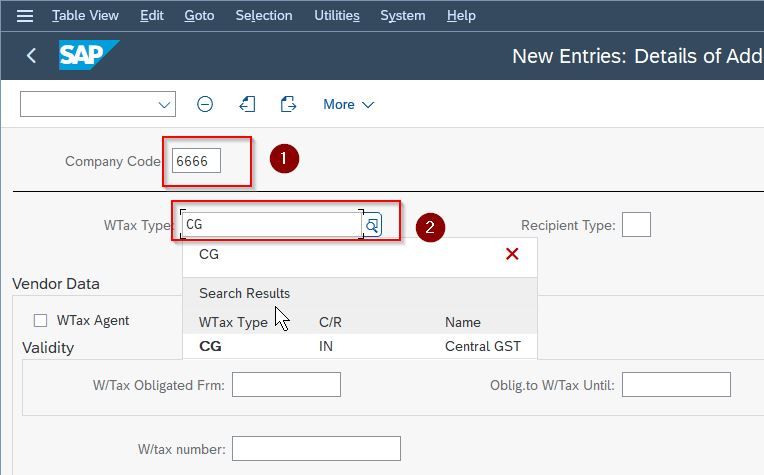

Now click the New Entries button

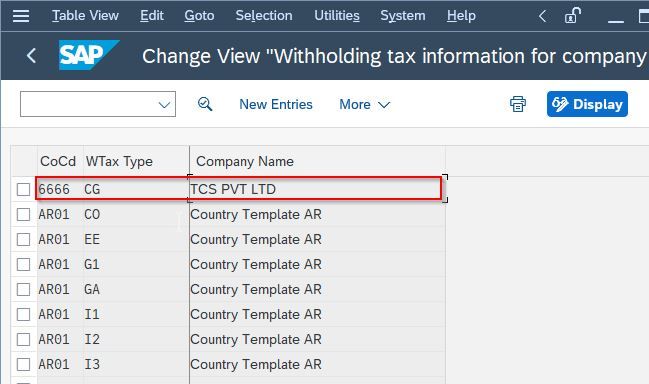

Assign withholding tax types to company code and click Save

Likewise, assign other tax codes (CC, IG, SG, and UG) to the company code.

Steps to maintain G/L accounts for Withholding tax offsetting entry

Navigate to the following SAP IMG men

Financial Accounting-> Financial accounting global settings-> Withholding tax-> Extended withholding tax-> Posting-> Accounts for Withholding Tax-> Define accounts for withholding tax offsetting entry.

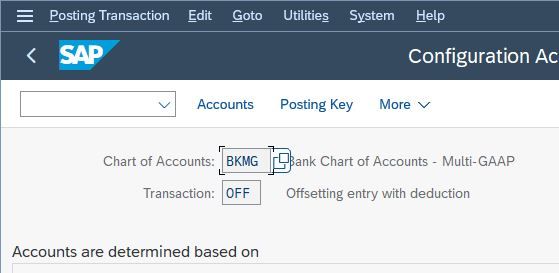

Next enter Chart of account id and press Enter to proceed

.jpg)

Note: For G/L account and recon. accounts, field status should have WHT enabled.