Maintaining Condition Table

Execute the transaction V/03

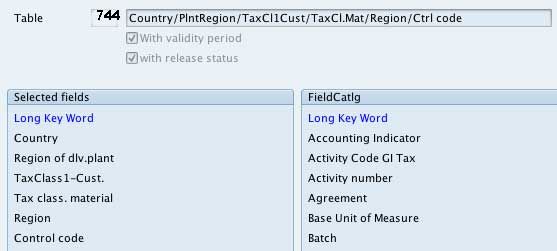

Source Combination : Country/ PlntRegion/ TaxCl1Cust/ TaxCl.Mat/Region/ Ctrl code

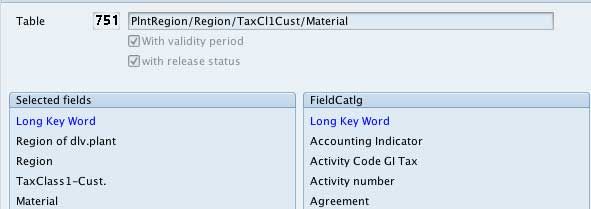

Source combination: PlntRegion/Region/TaxCl1Cust/Material

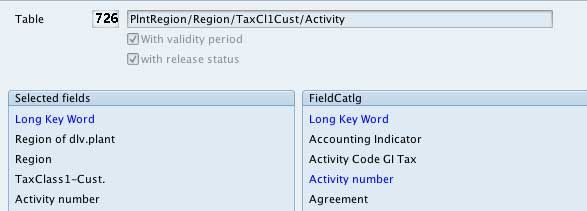

Source combination: PlntRegion/Region/TaxCl1Cust/Activity

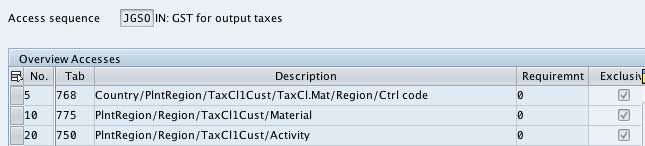

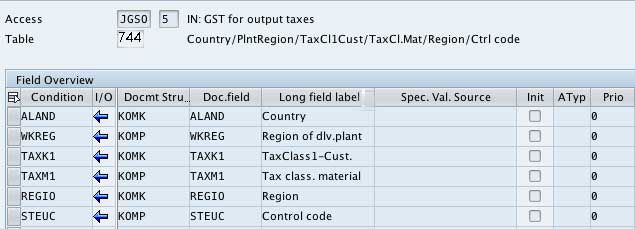

Access Sequence Maintenance

Executing t-code V/07

Source access sequence created – JGSO – IN: GST for output taxes

Field Assignment:

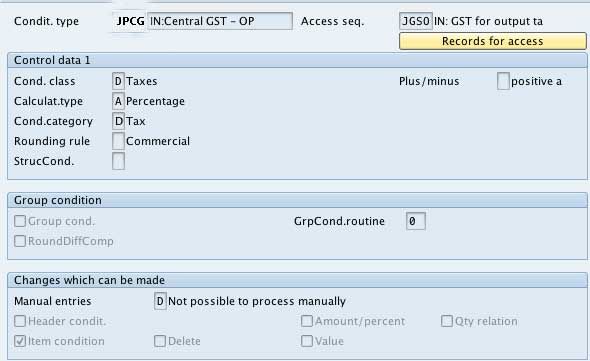

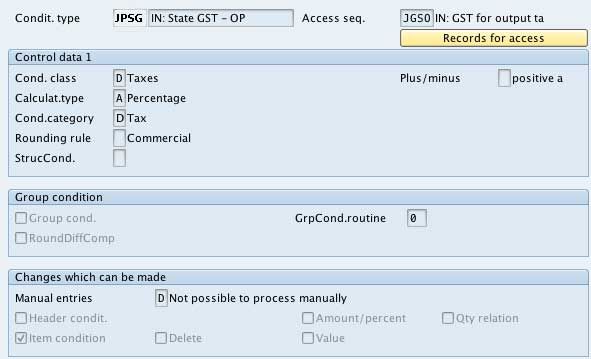

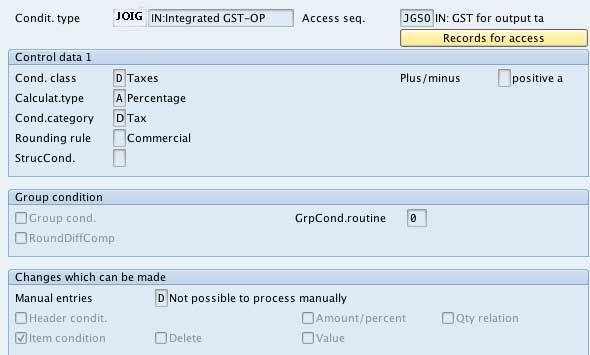

Condition types

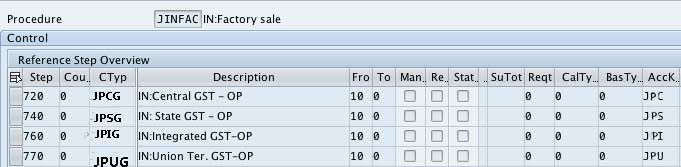

Make the changes to the pricing procedure JINFAC as given below

Create the following tax output condition types for GST

- JPCG - IN: Central GST - OP

- JPSG - IN: State GST – OP

- JPIG - IN: Integrated GST-OP

- JPUG - IN: Union Ter. GST-OP

NOTE: The condition types mentioned in this tutorial are for only examples.

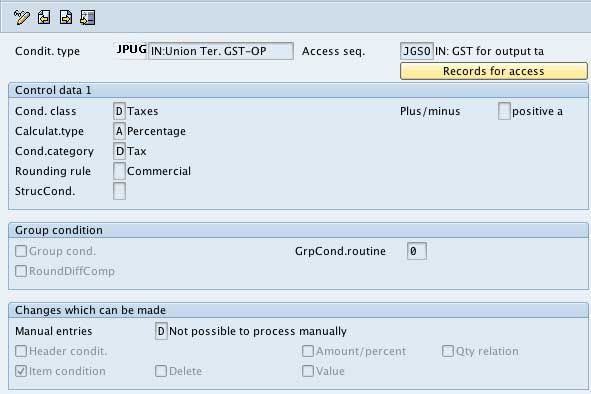

Executing the t-code V/06

Condition type for Central GST - JPCG - IN: Central GST - OP

Condition type for Central GST - JPSG - IN: State GST – OP

Condition type for Central GST - JPIG - IN: Integrated GST-OP

Condition type for Central GST - JPUG - IN: Union Ter. GST-OP

Accounting Keys

Executing T-code OV34

Deductible Condition Types Accounting key

| Account Key | Corresponding condition type |

| JPS – State GST- OP | JPSG -IN: State GST – OP |

| JPC - Central GST - OP | JPCG -IN: Central GST - OP |

| JPI - Integrated GST- OP | JPIG -IN: Integrated GST-OP |

| JPU - Union Ter. GST - OP | JPUG -IN: Union Ter. GST-OP |

Pricing Procedure JINFAC Update

Executing T-code V/08

Please as shown below maintain the defined condition types and account keys in the pricing procedure.

Note: ‘10’ refers to the base price in the above image.

Classify Condition Types

Classify the condition types in the view - J_1IEXCDEFN through the transaction SM30

| Proc. | CTyp | Condition Name |

| JINFAC | JPCG | CGSTAR |

| JINFAC | JPSG | SGSTAR |

| JINFAC | JPIG | IGSTAR |

| JINFAC | JPUG | UGSTAR |