What are Posting Rules?

Posting Rules in SAP are used to determine how financial transactions are posted to different accounts. A posting rule is a combination of a transaction type, a chart of accounts, and an account determination group. When a financial transaction occurs, SAP uses the posting rule to determine which accounts should be debited and which accounts should be credited.

Posting rules are used in a variety of SAP modules, including Financial Accounting (FI), Controlling (CO), and Materials Management (MM). They are typically configured by a system administrator or a consultant during the implementation of SAP.

Advantages of Creating Posting in SAP System

Defining posting rules in SAP has several advantages:

-

Improved accuracy: Posting rules help ensure that financial transactions are posted to the correct accounts. By defining the accounts to be debited and credited based on transaction type, posting rules reduce the risk of errors and ensure that financial statements are accurate.

-

Time-saving: Posting rules can save time by automating the posting process. Instead of manually determining which accounts to post to for each transaction, SAP uses the posting rule to determine the accounts automatically.

-

Customization: Posting rules can be customized to fit the specific needs of an organization. By defining unique rules for different transaction types, organizations can ensure that financial transactions are posted in a way that is consistent with their internal policies and procedures.

-

Flexibility: Posting rules can be updated and modified as needed. As an organization's financial requirements change, posting rules can be adjusted to accommodate these changes.

-

Transparency: Posting rules provide transparency in the financial posting process. By defining the accounts that are debited and credited for each transaction, organizations can ensure that financial statements are transparent and understandable to stakeholders.

How to Create a Posting Rule in SAP?

Please follow the steps below to create a posting rule in SAP:

Enter t-code OB40 in the SAP command field and execute it.

or navigate to the following IMG Path:

Financial Accounting > Financial Accounting Global Settings > Document > Document Header > Define Posting Keys

Next click on New Entries to create a new posting rule.

Enter a unique key for the posting rule, along with a description.

Select the transaction type that the posting rule applies to (e.g. vendor invoice, customer payment, general journal entry).

Select the chart of accounts that the posting rule applies to.

Select the account determination group that the posting rule applies.

Note: The account determination group is used to determine which accounts should be debited and credited based on the transaction type.

Click on the Save button to save the new posting rule.

Posting Rules for Bank Transactions

In SAP, you can define posting rules for banks using the following steps:

-

Access the transaction code OBVU or navigate to the following menu path: Financial Accounting > Banks > Master Data > Bank Master Data > Bank Key > Posting Rule.

-

On the Posting Rule screen, you will see a list of existing posting rules. To create a new rule, click on the New Entries button.

-

Enter the bank key and account ID for the posting rule.

-

Choose the posting rule type, which can be one of the following:

- Bank Charges: Used to post bank charges or fees.

- Bank Interest: Used to post interest earned from bank accounts.

- Bank Transactions: Used to post other types of bank transactions, such as incoming or outgoing transfers.

-

Enter the GL accounts to be used for debiting and crediting the posting rule.

-

Save the posting rule.

After you have defined your posting rules, you can assign them to individual bank accounts in the bank master data. When you create a bank transaction, SAP will automatically use the assigned posting rule to determine the GL accounts to be used for the posting.

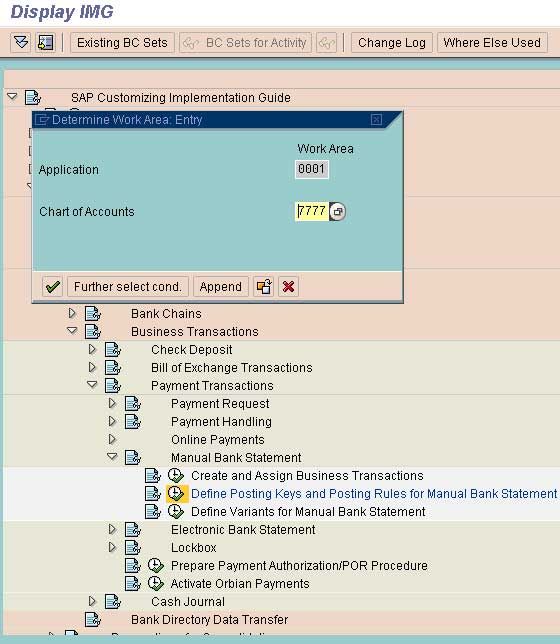

Financial Accounting

Bank Accounting

Business Transaction

Payment Transaction

Manual Bank Statement

Define posting key ad Posting Rules for Bank

Enter

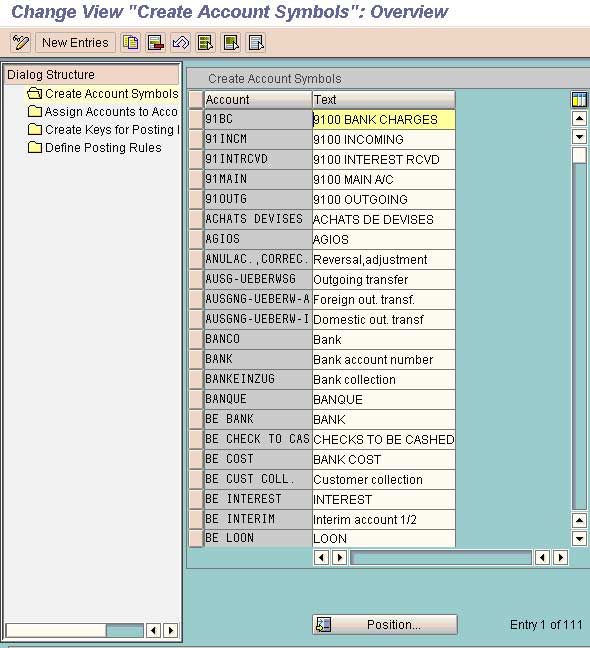

Select New Entries

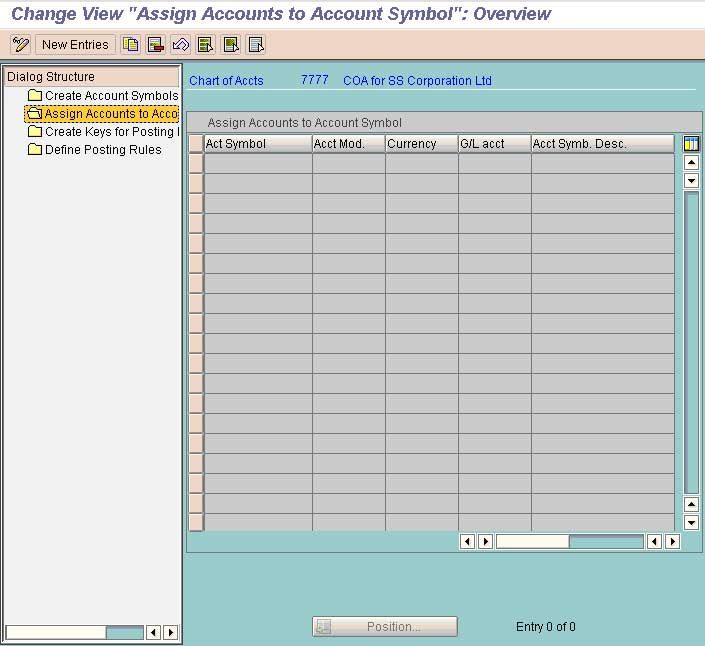

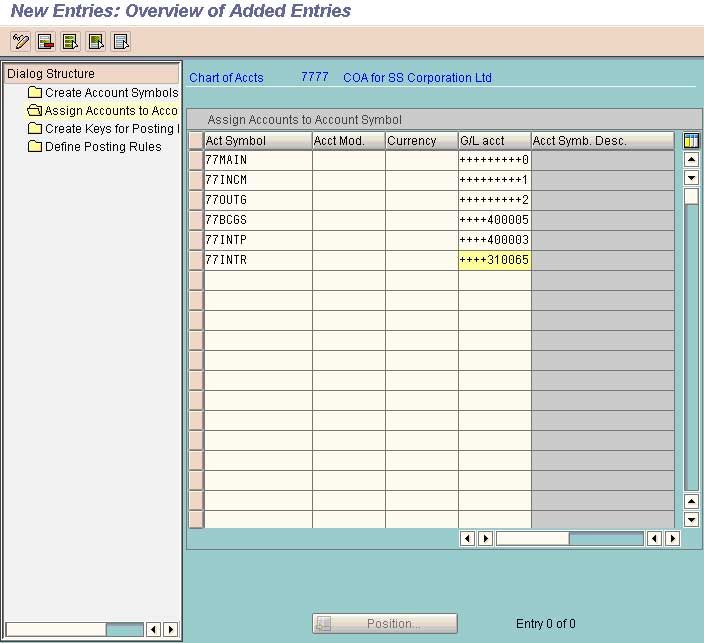

Save and go to the next option Assign Account to Account Symbol

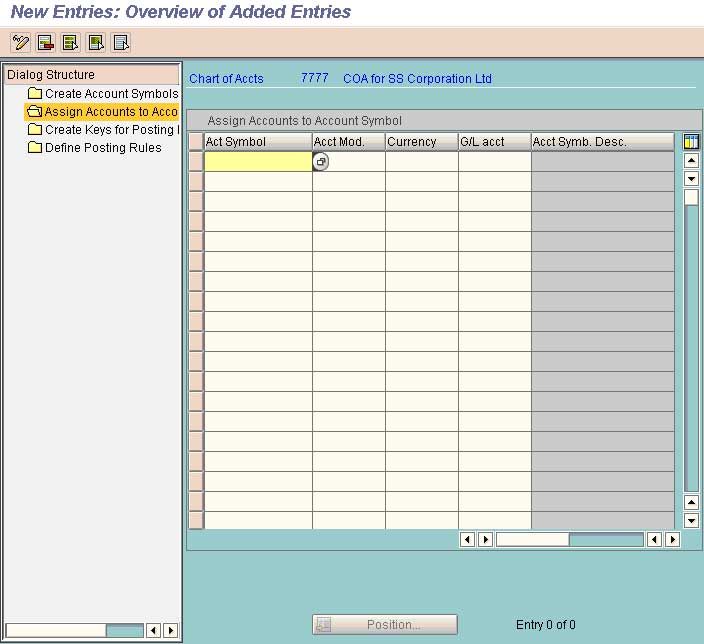

Select New Entries

Acct Symbol: The symbolic name as created above

GL Account The GL Account Number to which the transaction will get posted using the Account symbol. In case any business have more then one House

Banks and multiple bank reconciliation accounts then either each house bank and reco account has to be assigned to the symbolic name individually or standard pattern of creating the GL Accounts for various bank Accounts and reco accounts can be selected. Under the second option the house bank has to be given a GL Account no ending with 0 and the incoming and outgoing payment account of that bank account has to be ended with 1 and 2 respectively.

Complete the data and save

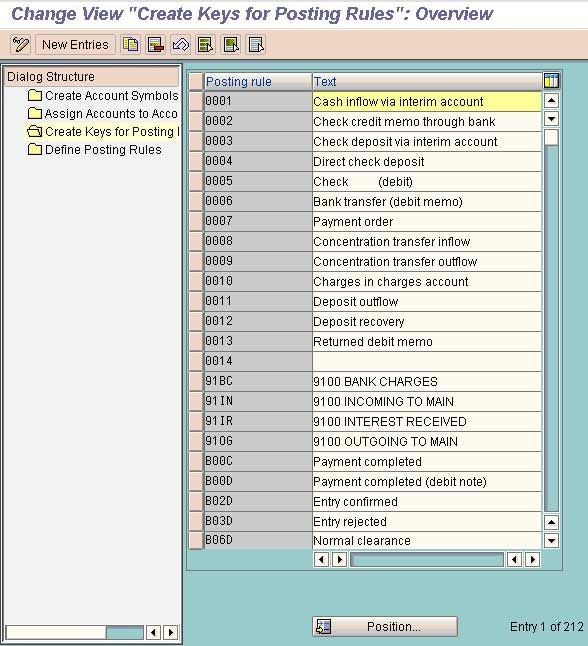

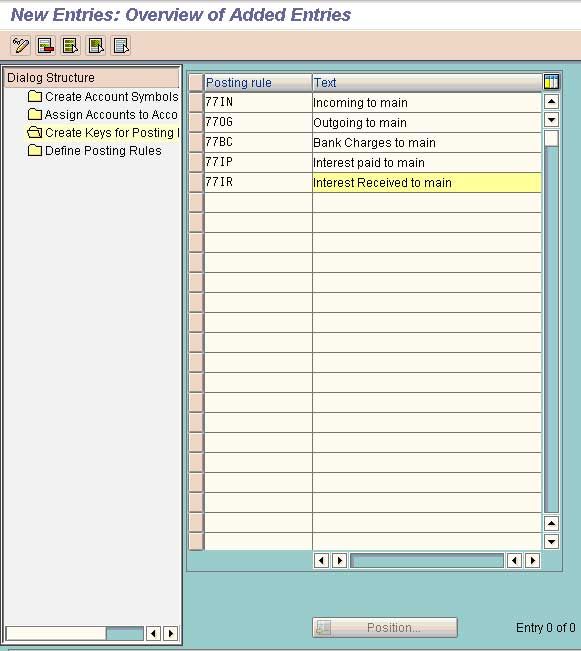

Go to the option create Keys for posting rules

Select New Entries

Posting key= A symbolic name of a posting rule to be defined in the next step.

Text Short text of the posting Keys

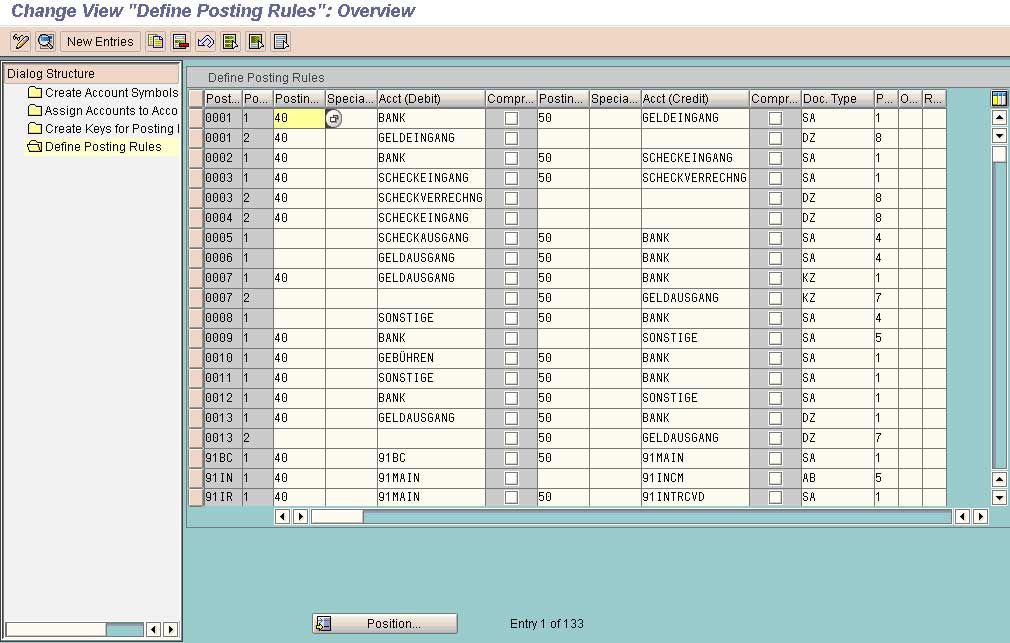

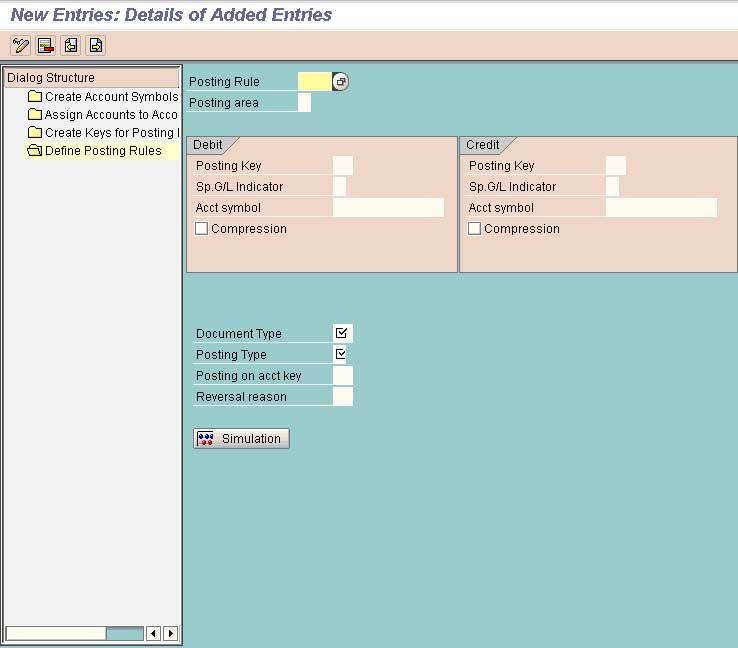

Save and go the option Define Posting Rules

Select New Rules

Special G/L Indicator

Indicator which identifies a special G/L transaction.

Posting Rule: As defined under the option create posting keys. Here we are defining the rule for this particular posting key

Posting Key Under Debit: The posting key that will be used for debiting the transaction

Account Symbol: The Account Symbol as created under the option Create Account Symbol and as assigned to a particular GL Account under this symbol

Document Type: The document type as applicable to the transaction

Posting Type: Under this we specify the rule how the respective account should get affected.

Following is the meaning of the posting types as defined by SAP and used by the

business

1. Post to GL Account: Post a transaction simply to the GL Account (i.e. main account and the respective expenses account) without giving effect to any other sub ledger account or clearing any account

2. Post Sub Ledger A/C Debit: This option is used for defining the posting keys for cheque payment. The meaning of this option is that give the effect of the entry in the debit of the sub ledger

3.. Post Sub Ledger A/C Credit: This option is used for defining the posting keys for cheque receipts.

4. Clear Debit GL Account: Means post the transaction to the debit of the account as speicified in the debit column and clear the transaction from that account

5.Clear credit GL Account: Means post the transaction to the credit of the account

as speicified in the credit column and clear the transaction from that account

7. Clear Debit Sub Ledger A/c: By using this option it is indicated that the sub

Ledger account will get debited and the balalnce corresponding to the

entry will get cleared.

8. Clear Credit sub ledger A/C: By using this option it is indicated that the sub

ledger account will get credited ad the balance corresponding to the entry

will also get cleared

Enter the data and define the next rule for a posting key by selecting the option next from

the task bar

Keep Going to the next screen till all the posting rules are defined for all the posting keys.

Save and exit

Following are the basic reasons for Bank Reco:

Cheque issued but not presented for payment

Cheque deposited but not presented for payment

Debited by bank but not credited by the business

(such as bank charges, interest paid,)

Credited by the bank but not by the business

(Interest Received)